Many professional service firms use job costing as a way to track specific costs by job to see if those costs can be reduced in future projects. If you’re practicing job costing, you should also be conducting job cost reporting as well. The following reports are going to be the ones that essentially manage your projects. These will help you see how you’re doing, make sure you’re in line with your budget, and (if it happens) understand why there is a budget overrun. Learn more about project profitability here.

Below are the reports that should be coming out of your PSA software and are part of your monthly review. Some of these reports are just for project managers while others can be sent to just the CFO.

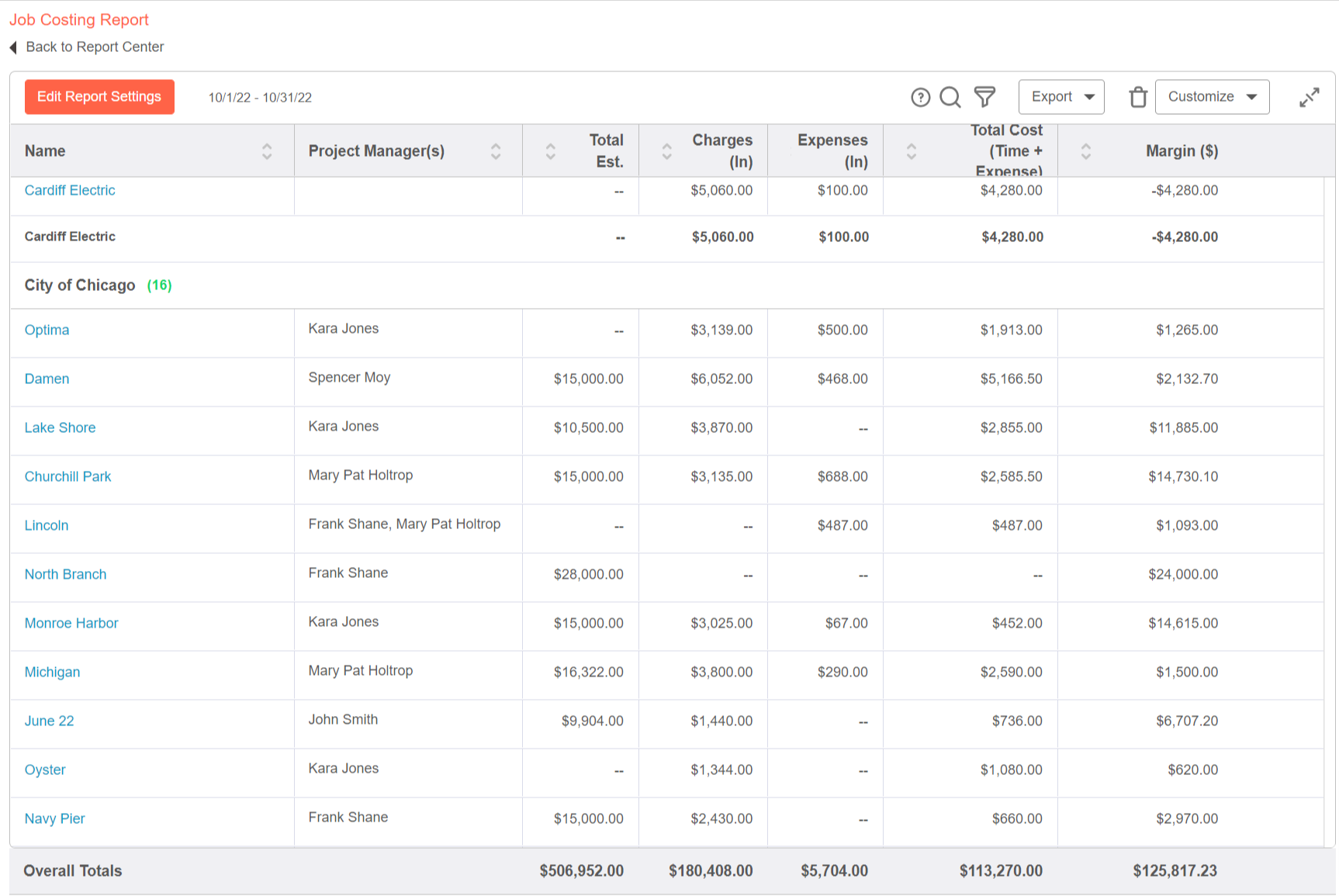

Job status report

This report is essentially going to give you your revenue, your direct costs, your contract value, your funded contract value, who the project manager is, your gross margin line, and the application of indirect rates.

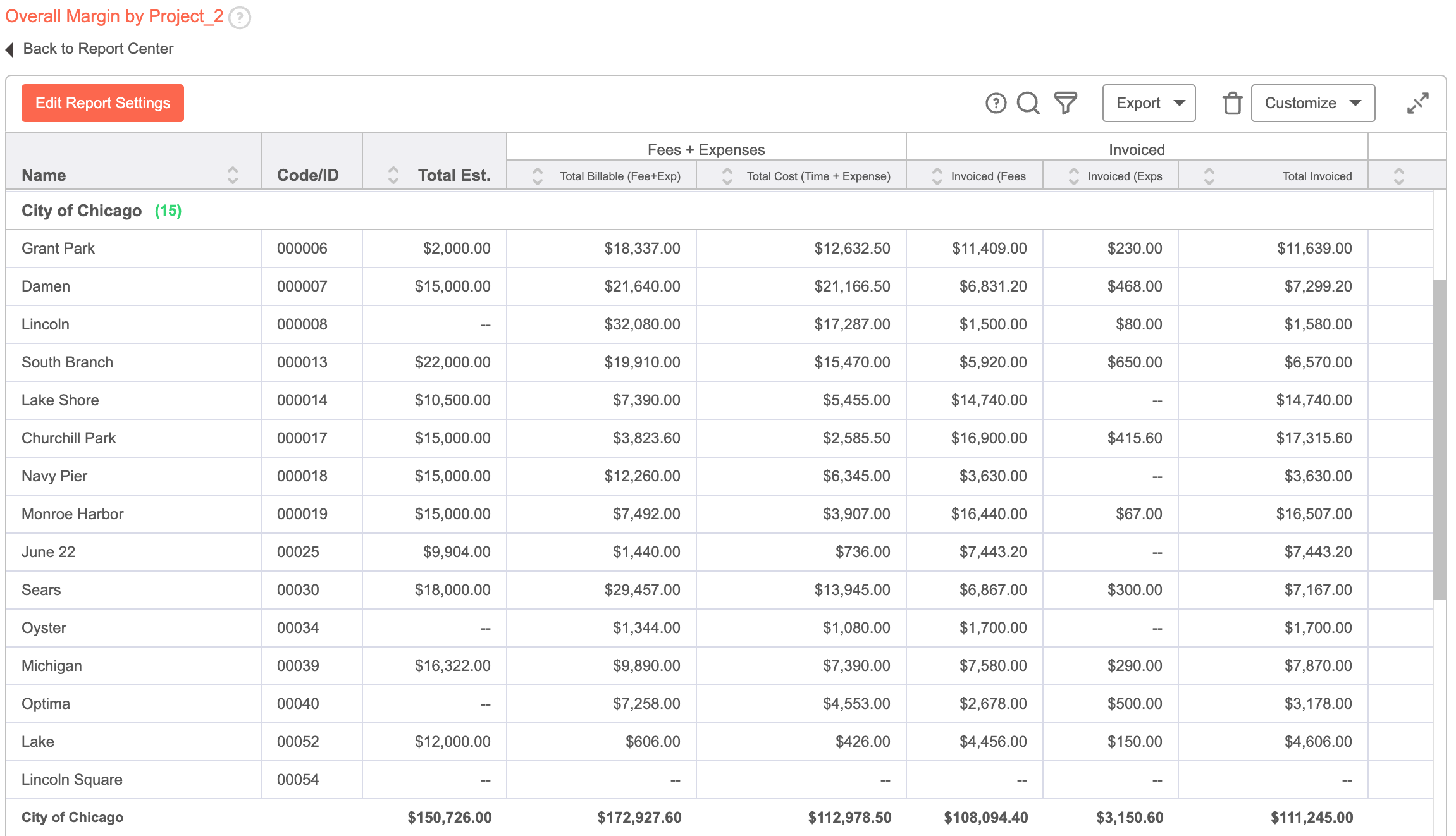

Overall Margin by Project

Also known as project budget vs. actuals. With this report, you’re going to be able to see how you’re comparing your actual results against the original project budget. Comparing these results will give you a better look at your firm’s performance. Be sure to pay special attention to the details shown. This report should be itemized in a way that allows you to have a better understanding of your firm’s financial situation and the reasons behind any variations.

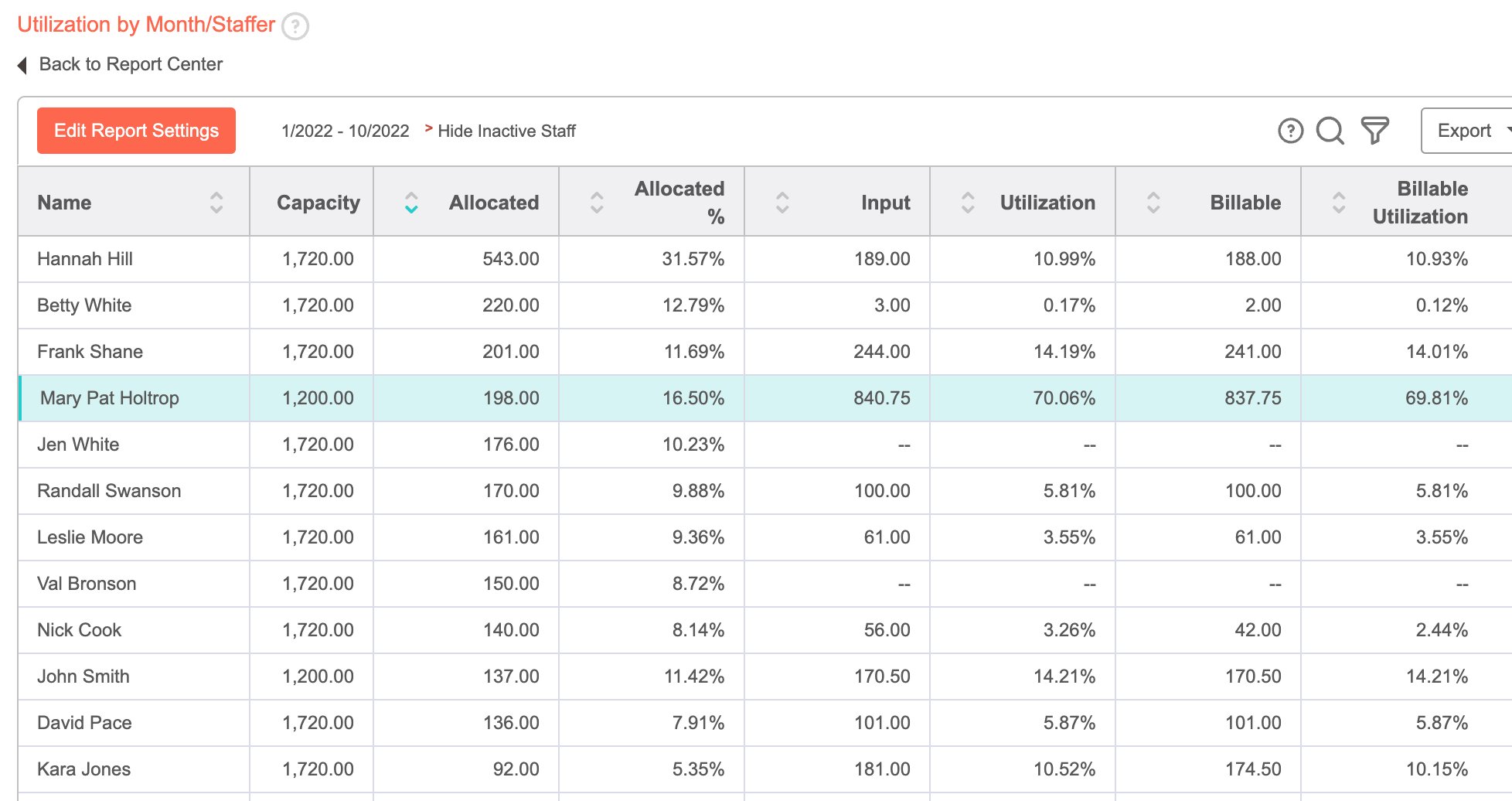

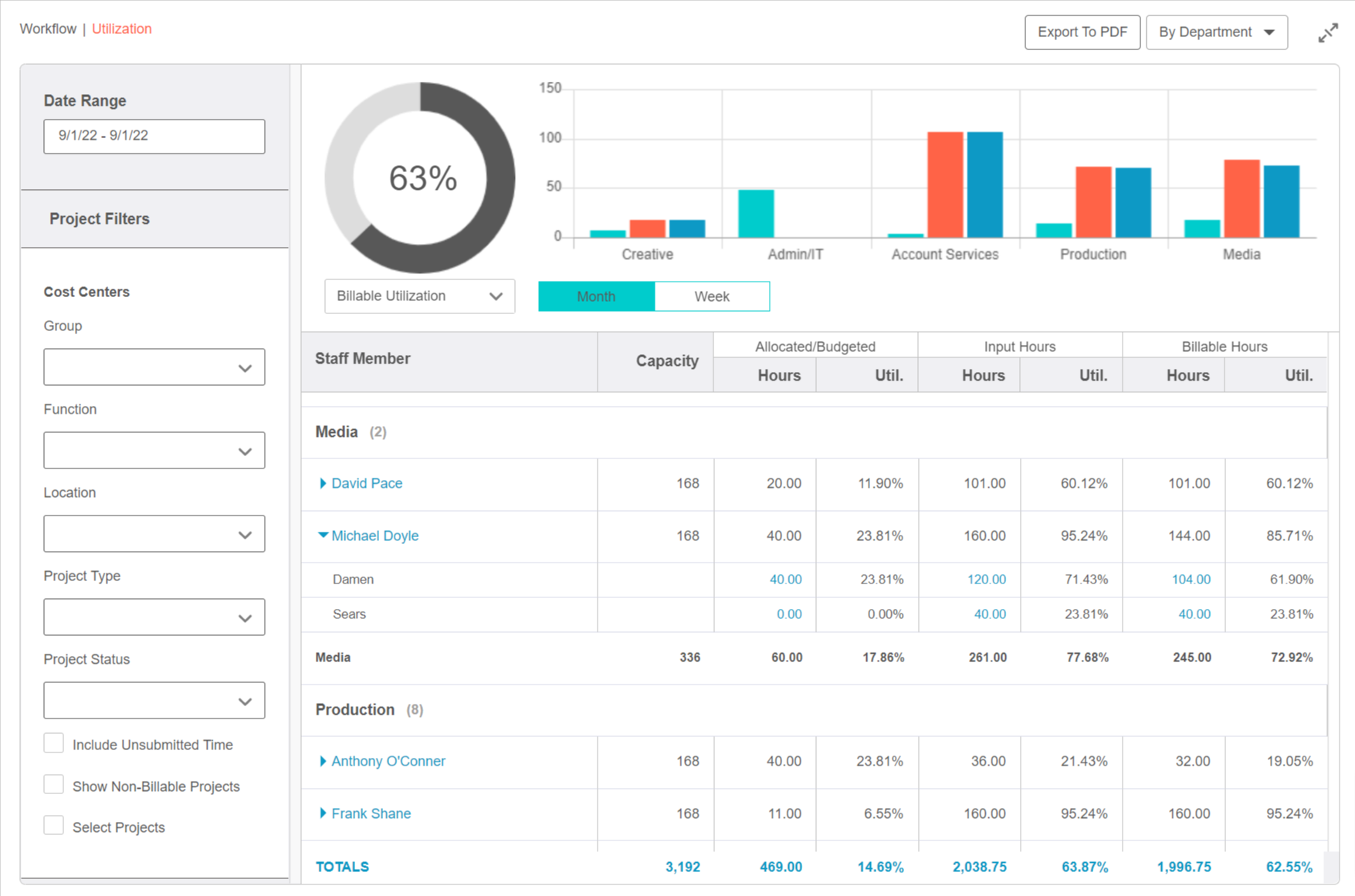

Utilization by month/staffer

Also known as labor utilization. This report is very important and should be done company-wide as well as by employee. As a professional services company, you’re going to have a lower company-wide utilization rate because you have admin, accounting, HR, and IT staff that is going to bring your labor utilization rate down from an overall perspective. However, you can bucket these reports by your indirect staff versus your direct staff. You’ll then want to look at your labor utilization by employee, especially when it comes to your direct staff. If someone is supposed to be 100% billable and they’re only billing 60% of the time, why is that? Keeping a pulse on this labor utilization report is really important for the success of your company.

Pro tip: For even more insight, you can use the utilization dashboard in BigTime (shown below). This helps you keep a real-time pulse on staff utilization. It’s more dynamic than a report because you can manipulate data, and the dashboard goes into even more detail than the report, which just shows you a summary. You can also download the dashboard as a PDF and bring that to a monthly meeting.

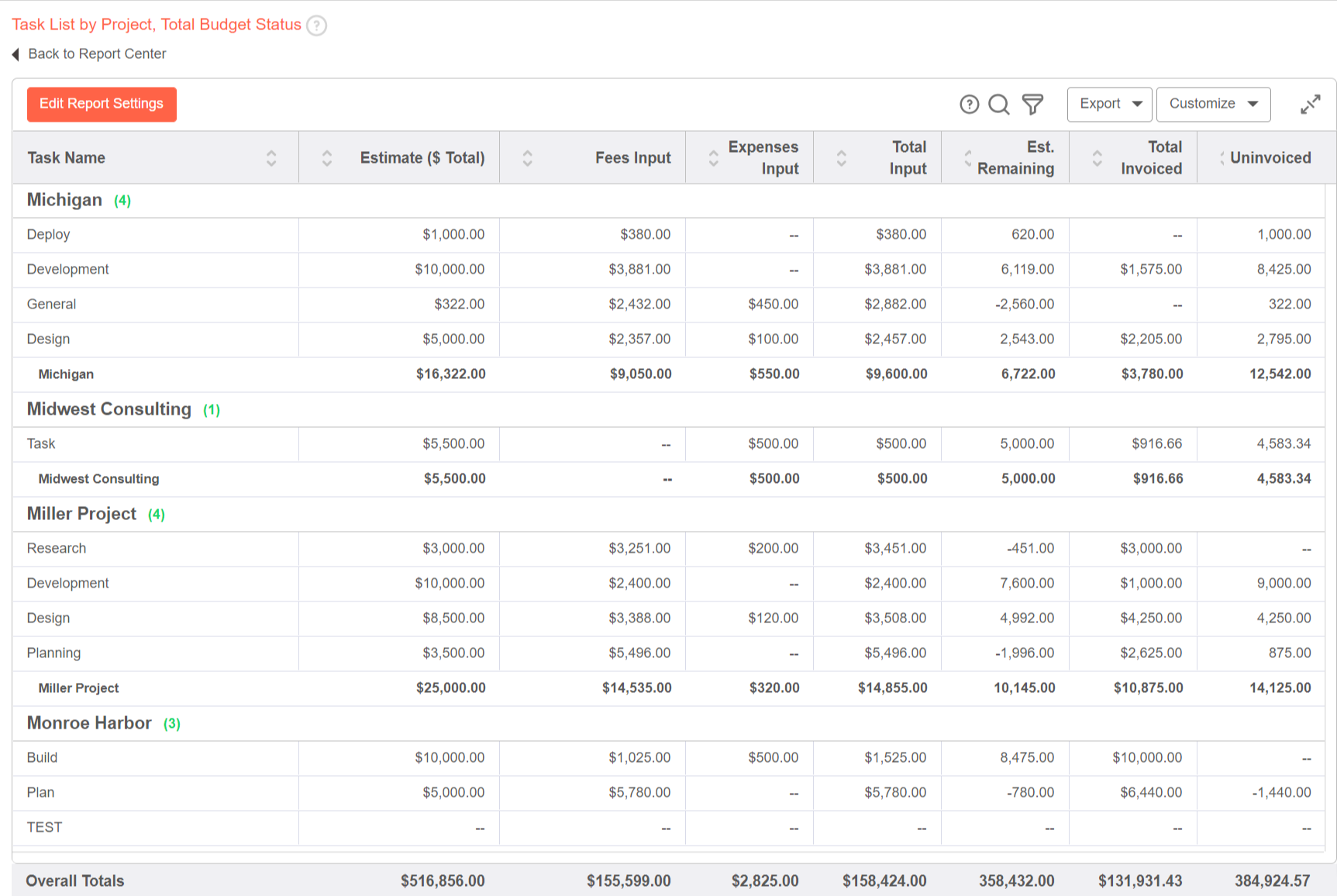

Task list by project, total budget status

Also known as backlog reporting. This should be showing you all of your contracts and contract value on each of them, as well as your funded value for each. You want to make sure that you’re looking at your backlog between your actual value that you’ve been rewarded versus what’s actually been funded. In your backlog report, you want to include your revenue that you’ve generated to date and then what you’ve billed to date (that might not be the same number). That will show you what you have left to bill on a contract so you can start to monitor that budget as well as how much work is left to do on a project.

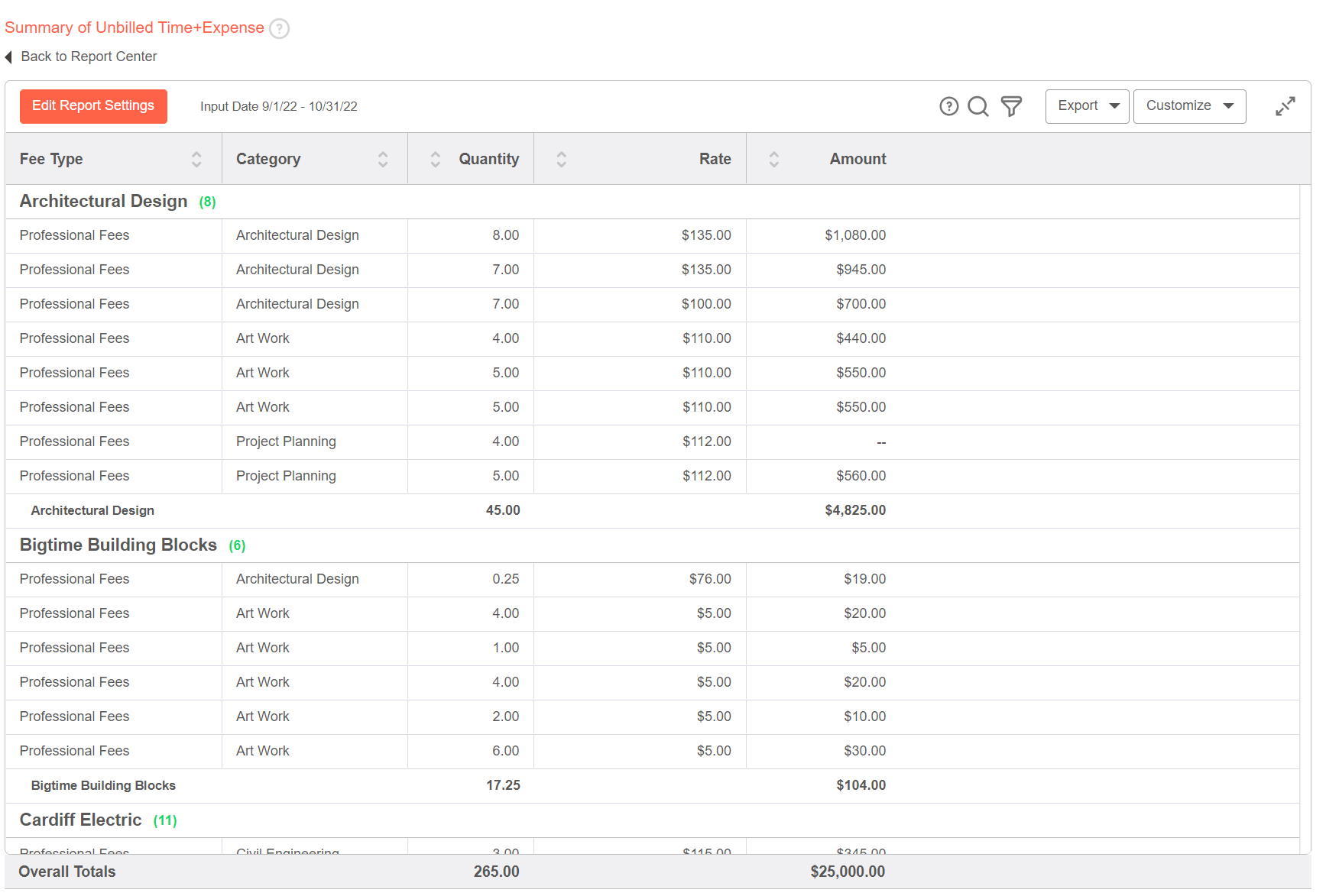

Summary of unbilled time & expense

This report comes from accounting. Sometimes there will be some unbilled amounts that haven’t been billed to the customer for whatever reason. You want to look at these customer amounts and make sure they are accurate and you agree with them, especially as they start to accumulate.

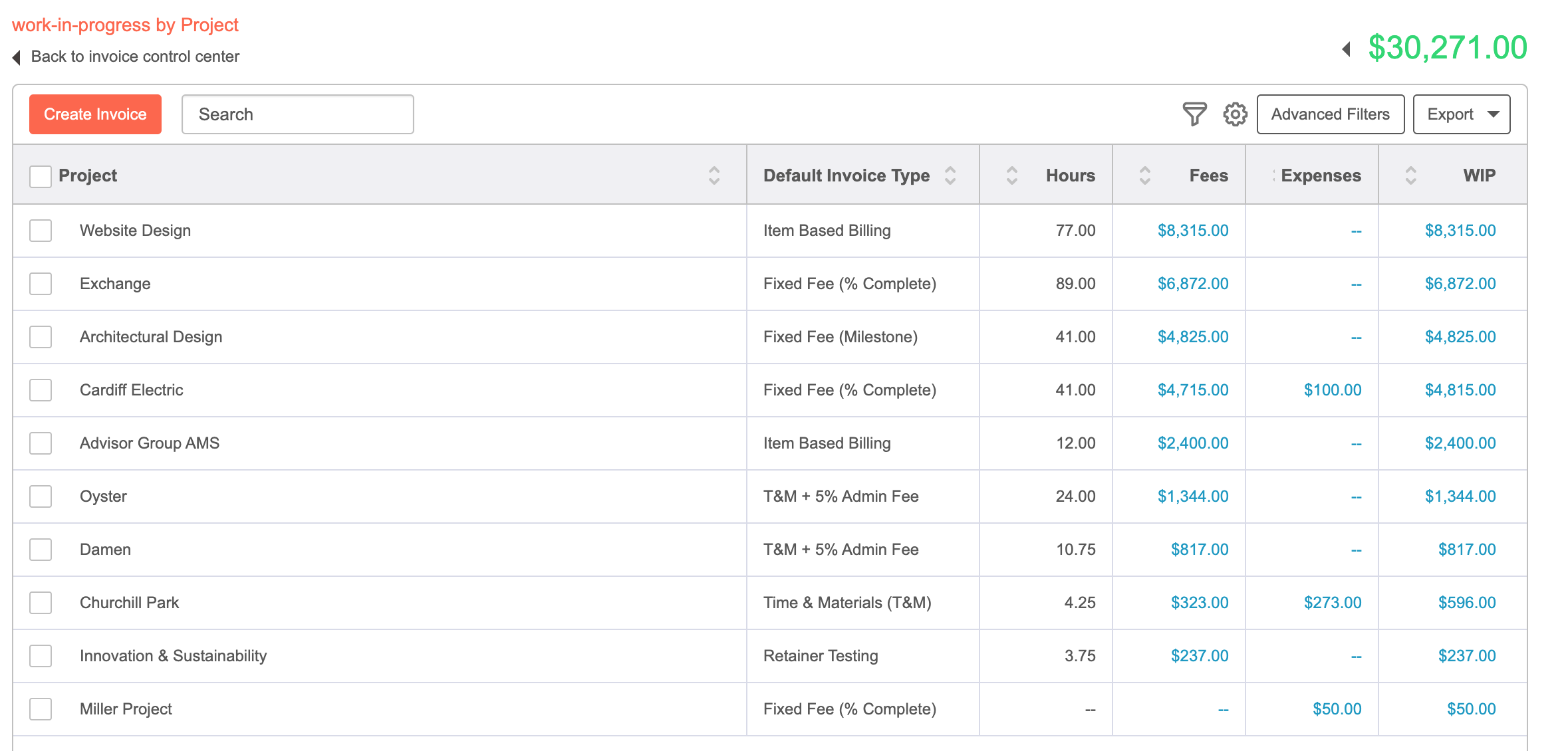

Pro tip: The easiest way to keep track of unbilled expenses in BigTime is the work in progress (WIP) tile under invoicing (see below), which shows a total of all unbilled time/expenses. When you click into the tile, you see this broken down by project.

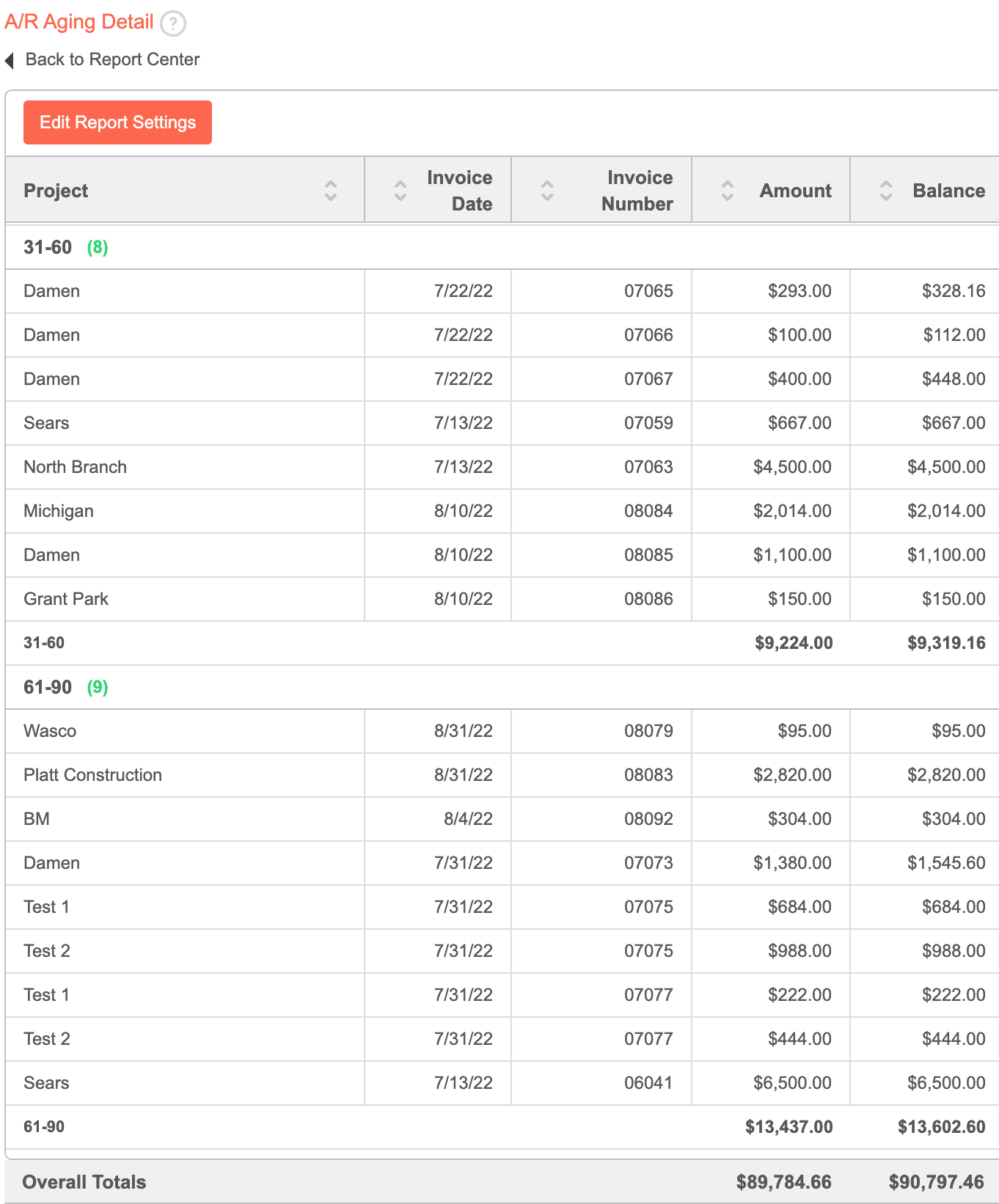

A/R aging detail

Also known as open customer receivables. You don’t want your receivables to get over 60 days, that’s just money out of your pocket. Anything that starts to creep over 60 days needs to be addressed and/or investigated as to why no payment has been made.

Finding the Right Tool to Help

Using a professional service automation tool like BigTime allows you to track important reports, KPIs, hours worked, and more — all in real time to help automate job cost reporting.

BigTime provides you with multiple pre-built reports, in addition to giving you the ability to create your own custom reports so you can always keep a pulse on project health. Ready to learn more? Request a demo here.

Looking for more information on this topic? Be sure to join our upcoming interactive workshop for professional service firms on job costing and improving project margins.

Frequently Asked Questions About Job Cost Reporting

What’s the definition of job costing?

Accumulating costs of materials, labor, and overheads for a specific job or project.

What’s the definition of job cost reporting?

Simply put, this is a report that tracks the ongoing cost of a project.

Why is job cost reporting important?

Job cost reporting provides helpful Information on the current cost status of the job. This information can help project managers estimate what the real cost of the project will be at completion. Having this estimate prevents any surprises for both you and your clients. No one wants a surprise invoice and proper job cost reporting can often prevent them.

Job cost reporting can also be your best friend for revenue forecasting. These reports can give you insight into whether a low-profit month is the result of one job or because of outside factors.

Another huge perk of job cost reporting is when you use them to compare current money spent versus budgeted costs, you get a better understanding of whether your project is on or off schedule and can help to improve project profitability. Look at your job estimate that includes a detailed summary of hours, cost of materials, scope, exclusions, completion dates and timelines, and more. Then, look at your job cost report. What’s missing? What resource has gone over? This comparison should really be a helpful aid in knowing what to expect, whether you’re gonna be over budget or right on budget.