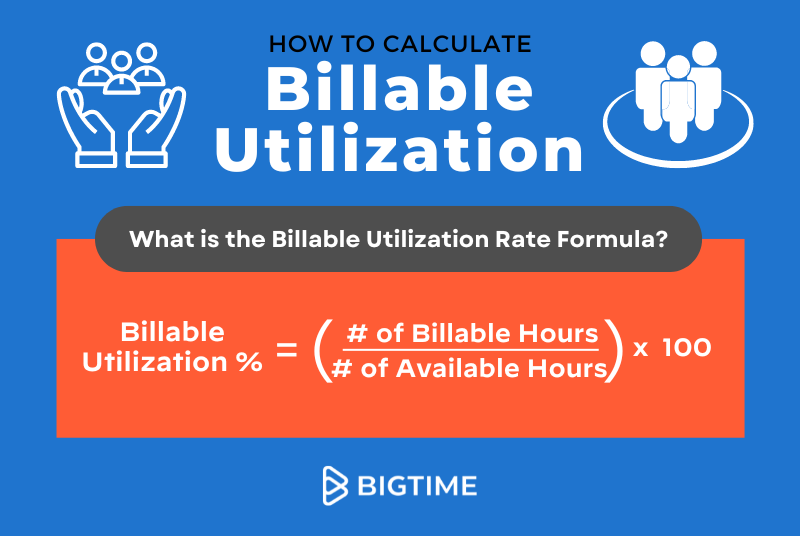

What is Billable Utilization?

Billable Utilization % = (Number of Billable Hours / Number of Available Hours) X 100%

The billable utilization rate is one of the most important Key Performance Indicators (KPIs) measured by almost all professional services firms.

Billable utilization. Every professional services firm I’ve ever worked with—whether they’re a management consultancy, a digital marketing organization, or a technology implementer—calculates and measures billable utilization. Every professional services manager—from the executive leadership level to delivery managers to department heads—tries to improve billable utilization. Every billable consultant is, at least in part, evaluated and compensated on billable utilization.

The problem is, not everyone has a common understanding of billable utilization or how to calculate it.

Billable Utilization Rate Formula

On the face of it, billable utilization, also known as a utilization calculation or utilization rate, is a simple concept that measures how much time people are spending generating revenue. You take the hours that people are billable, divide by the hours they’re available and come up with a percentage using this billable utilization rate formula:

Other Names for Billable Utilization

When it comes to how to calculate a utilization rate to determine an organization’s billable utilization metrics, other terms you may come across include:

- Utilization calculation

- Employee utilization calculation

- Consultant utilization rate

- Utilization rate formula

- Billable utilization calculation

- Consulting utilization rate

- Effective utilization formula

- Employee utilization rate

- Billable rate

- Utilisation percentage

- Resource utilization in project management

However you refer to it, when you use the formula for utilization rate, the next step is to compare that percentage to other firms, to other departments, to other people, and then (at least in theory) you have a way of measuring performance. This assumes everyone is calculating utilization the same way.

The trouble is, things are rarely that simple if you really want to use something like professional services billable utilization to drive beneficial behaviors. Here’s what you need to think about when measuring billable utilization for your professional services firm.

Billable Utilization Formula: The Numerator

Explanation:

The numerator of the utilization calculation is driven by what behavior you want to encourage. Most services organizations take a very simplistic view and just measure billable utilization… time spent working on billable projects.

A Simple View:

Such a one-dimensional view, however, can sometimes lead to contradictory incentives. Should the less efficient consultant who spends more time on a particular task than a more efficient consultant get more utilization credit?

What about a person who does a bunch of work that you can’t charge the client for because someone else had to redo it? How do you measure people who aren’t working directly on billable projects but rather internal projects, yet are still doing work vital to the organization? Do these situations still benefit from a singular focus on billable utilization as their employee utilization rate?

A Nuanced View:

Many top-performing professional services firms take a more nuanced view, and oftentimes have multiple resource utilization measures. In addition to measuring billable utilization, they may also measure:

- Chargeable utilization: measures time spent on billable projects, but only billable time that actually generates revenue

- Productive utilization: measures the number of hours spent on non-billable work deemed vital to the ongoing business of the firm, such as business development or product development

- Total utilization: measures overall utilization, for example, to make sure someone in the finance department isn’t consistently logging 100-hour weeks

Billable Utilization Formula: The Denominator

Explanation:

The denominator of the resource utilization rate is driven by how the organization defines each person’s availability. Like the numerator, how an organization calculates the denominator may also drive behavior.

A Simple View:

For example, people are generally not working on billable projects or generating revenue during company holidays or sick time. Given that, the decision of whether or not to count those hours as available hours in the denominator affects the utilization calculation.

If people feel that taking sick time will count against them when computing their utilization, they may be less likely to stay in bed when they’re ill. In addition, since the summer months and the holidays are oftentimes peak times for vacation, including time off and holidays in the denominator can lead to variability due to seasonal effects in utilization.

As a result, there are some advantages to keeping time away from the office out of the calculation.

A Nuanced View:

Like with the numerator, many top-performing firms will also take a more nuanced view of the utilization calculation’s denominator, depending on what they are trying to measure.

They may want a better understanding of the capacity of their team. In other words, how much productivity are they getting out of current staff without adding or removing people from the organization?

On the other hand, they may want an understanding of the efficiency of their labor investment. In other words, how much productivity is the company receiving in comparison to what they’re paying for? That difference may be non-existent if the entire staff is salaried. However, when you start factoring in subcontractors paid on an hourly basis or non-exempt employees eligible for overtime, it’s a whole different story.

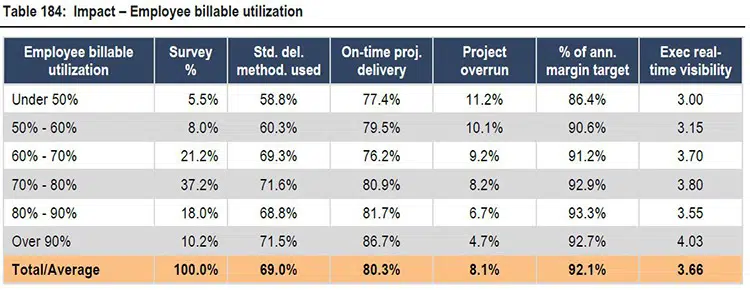

As employee billable utilization rates improve, benefits include higher on-time project delivery rates, lower project overruns, and more executive real-time visibility. (Source: 2022 SPI Research)

Professional Services Utilization Benchmarks

Explanation:

Once a firm has settled on an approach to calculate a utilization percentage, the next step is to determine what a reasonable utilization target is. Or, perhaps I should say what its approaches are and what reasonable utilization targets are—both of which may vary depending on the firm’s needs and goals.

If you don’t know better, you may constantly strive toward the 100% utilization rate mark. However, a “perfect” utilization percentage suggests that employees are overworked and may have little to no job satisfaction. What if the utilization rate is above 100%? Then your organization is guilty of poor resource allocation, management, and planning.

A Simple View:

Many organizations aim for utilization rates around 80% and will measure billable utilization against a 2,000 hour per year target when benchmarking themselves against the market. It’s simple, it’s consistent, it doesn’t require a ton of thought, and it’s easily comparable to industry benchmarks like the SPI Benchmark Survey. However, it’s also important to consider the demands of clients and the nature of the job.

A Nuanced View:

Also, companies may take a slightly more nuanced, but still straightforward measure for individual team members in the form of bonus calculations or metrics on individual dashboards. This measure is often utilization-based on productive hours divided by working hours minus holidays and time off. This can then be compared to a minimum productive utilization target.

Minimum and Maximum Utilization Targets

In addition, more sophisticated firms may use both a minimum and a maximum utilization target to improve the discipline of professional services resource management. Maximum targets may be used to help control overutilization, which may lead to unwanted employee attrition as described in this Forbes article on consulting burnout. Maximum billable or chargeable targets can also help ensure partially-billable managers set aside sufficient time for other activities such as staff development or account management.

In Summary

To sum it all up, a fairly simple notion of determining how busy people are is more nuanced than meets the eye, depending on what the organization is looking to accomplish.

Firms should consciously and deliberately decide which assumptions and approaches to use and understand what behaviors those decisions are likely to drive. Everyone who is responsible for measuring and optimizing resource utilization rates needs to understand the assumptions and ensure that the approaches are used consistently with their intent.

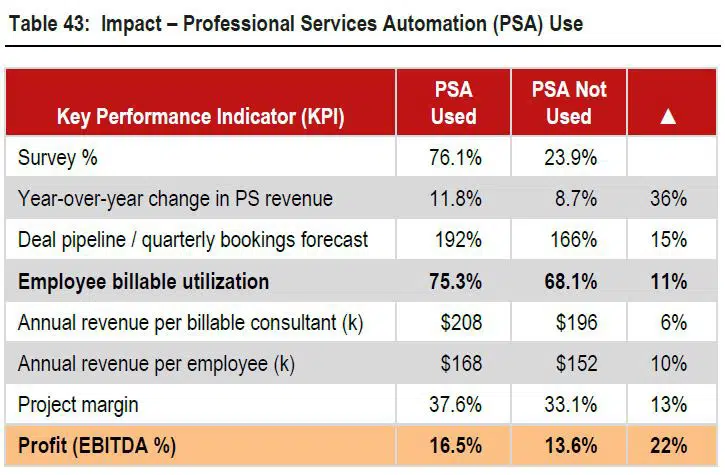

One of the most important aspects of measuring and managing utilization is being able to do it easily and consistently. Professional Services Automation (PSA) Software can help consulting firms do this, resulting in a higher utilization rate of 7 percentage points. This translates into improved billable utilization of nearly a whole month per billable employee per year.

PSA solutions yield several core benefits to professional services organizations, but most executives only need to look to the relative 11% (from 68.1% to 75.3%) increase in billable utilization as a primary reason to select PSA. (Source: 2022 SPI Research)

Finally, it’s important to understand that the different methods of calculating professional services billable utilization are not all mutually exclusive. Instead, they can be used in concert with one another. It’s also critical to know that optimizing utilization in isolation can actually be detrimental to the health of a services organization, and needs to be done in concert with all the other KPIs in the business.

To learn more about these other metrics, download our white paper, Metrics that Matter for Professional Services, or read more about billable utilization in our post about how optimal resource utilization can fuel growth. And don’t forget to download the SPI Research for benchmarking targets.

The price for poor resource allocation and management and utilization rate is getting costlier for businesses by the day, from hiring costs to clients dissatisfaction and contract termination. BigTime allows project managers to handle communication, resource management, and invoicing financials within the same comprehensive platform. Request a demo to learn more today!

Frequently Asked Questions About Billable Utilization

What is billable utilization?

Billable utilization measures the percentage of available hours that employees spend generating revenue for project-based services. The utilization rate formula is defined as: Billable Utilization % = (Number of Billable Hours / Number of Available Hours) X 100%. It’s one of the most important Key Performance Indicators (KPIs) measured by almost all professional services firms.

What is the billable utilization rate formula?

The billable utilization rate is calculated by this formula: Billable Utilization % = (Number of Hours People are Billable / Number of Hours People are Available) X 100%

What is utilization rate?

In simple terms, the utilization rate is the portion of an employee’s total working hours that is productive.

What is chargeable utilization?

Chargeable utilization is slightly different than billable utilization in that it does exactly what it says. It takes the work and hours that are actually chargeable to a customer, telling you what percentage of total hours billed contributes to your service organization’s revenue.

What is productive utilization?

Productive utilization measures the number of hours spent on non-billable work deemed vital to the ongoing business of the firm. It is a much more holistic measure that thinks about all of the work in a professional services organization, not just billable or chargeable. Not all good work is work that’s delivered to customers. It’s work that can be delivered internally that helps advance our business overall.

What is the meaning of utilization rate?

Billable utilization rate is essentially a measurement of the percentage of available time spent working on billable projects. It’s one of the most important Key Performance Indicators (KPIs) measured by almost all professional services firms.

How do you calculate utilization?

Utilization in professional services measures how much time people spend generating revenue. The utilization formula is: hours people are billable divided by the hours people are available, then multiplied by 100 to come up with a percentage.

What is utilization in professional services?

In the world of professional services, utilization is a measure of how efficiently you are using your resources. It can be thought of as a ratio that compares the amount of time you spend working on client projects with the amount of time you have available to do so.

How can billable utilization be improved?

According to the most recent Professional Services Maturity Benchmark report by SPI Research, the following factors have a direct correlation with improved billable utilization:

• Providing good leadership direction

• Utilizing effective communication

• Implementing a PSA tool

• Executing very effective service marketing

• Increasing the deal pipeline

• Limiting service discounts given

• Decreasing the amount of time it takes to recruit and hire

• Improving on-time delivery

• Developing effective estimating and process review processes

Why is billable utilization important?

Billable utilization is important to a professional services organization because it measures how well the business is using its resources and helps ensure revenue targets can be met.

Why is the calculation of utilization rate important?

Utilization percentage calculation helps you carefully evaluate internal resources allocation per project and check if the amount charged is profitable to the business. Calculating utilization rates also helps you analyze the individual approaches to job execution methods and optimize them until they are efficient.

What is a billable utilization example?

Billable utilization percentage can be calculated by dividing total productive hours by total available hours, then multiplied by 100. For example, if an employee’s productive and billable time in a 40-hour week is 26 hours, the employee utilization rate is 65% ((26/40) x 100).

.png)