Maintaining a healthy cash flow is critical to the success of any professional services organization. One important metric that often impacts cash flow is Days Sales Outstanding (DSO). High DSO means that a business is taking longer to collect customer payments, which can strain resources and hinder growth. Fortunately, Professional Services Automation (PSA) software can help significantly reduce DSO, improving an organization’s financial health.

This article explores how PSA software achieves this, why shorter DSO is crucial, and the features that make it possible.

High DSO and Its Impact

Days Sales Outstanding (DSO) is calculated by dividing the total accounts receivable during a specific period by the total value of credit sales during the same period, then multiplying the result by the number of days in the period. A high DSO indicates that a company is taking longer to collect payments from its clients, whereas a low DSO suggests efficient collection practices.

For professional services businesses, a high DSO can lead to several challenges, including:

Cash Flow Issues

High DSO ties up cash in unpaid invoices, leaving the organization with less cash on-hand to cover operational expenses, invest in growth opportunities, or handle unexpected costs. This can lead to cash flow problems, making it difficult to manage daily business activities smoothly

Increased Borrowing

To manage cash flow shortages, companies may need to rely on credit lines or loans, leading to additional interest expenses and debt. This increased financial burden can strain the company’s resources and negatively impact profitability.

Client Relationship Strain

Persistent delays in payment collection can create friction with clients. Clients who are frequently reminded about overdue payments may become dissatisfied, potentially harming long-term relationships and affecting future business opportunities.

Operational Inefficiency

Managing overdue accounts consumes valuable time and resources that could be better spent on core business activities. Administrative staff may spend excessive time following up on unpaid invoices, diverting their attention from more strategic tasks.

Decreased Profitability

Late payments can result in the need to offer discounts or incentives to encourage clients to pay faster, which can hurt profit margins. Additionally, the cost of borrowing to cover cash flow gaps can further reduce profitability.

Resource Allocation Issues

Funds tied up in receivables cannot be used for strategic investments or seizing new business opportunities. This limitation can hinder the organization’s ability to innovate and stay competitive in the market.

5 Ways PSA Software Helps Reduce DSO

After reviewing a high DSO’s impact on an organization, you’re probably wondering what you can do to reduce your average DSO. This is where Professional Services Automation (PSA) software comes in.

PSA software combines various functions such as resource management, project management, time and expense tracking, billing, and reporting into one unified platform, offering a comprehensive view of operations and finances.

Here are 5 specific ways PSA software helps reduce DSO:

1. Automated Invoicing and Billing

Example: A firm using PSA software can automate the creation and delivery of invoices based on predefined milestones or time entries. This ensures invoices are sent promptly and accurately, reducing delays caused by manual processes.

Best Practices to Shorten DSO with PSA Software:

- Scheduled billing: Set up automatic invoicing schedules aligned with project milestones or billing cycles.

- Customizable invoice templates: Create professional, branded invoices that can be automatically populated with project details.

- Invoice approval workflows: Implement approval processes for invoices to ensure accuracy and compliance before sending them to clients.

- Automated payment reminders: Send automatic reminders to clients about upcoming or overdue payments, ensuring they stay informed.

- Invoice tracking and status updates: Monitor the status of sent invoices in real-time to follow up on overdue payments promptly.

2. Make it Easy for Staff to Have All Time and Expense Data in on Time

Example: A firm tracks employee hours and project expenses in real-time using PSA software. This ensures that all billable hours and costs are accurately captured and included in invoices, eliminating discrepancies and disputes that can delay payment.

Best Practices to Shorten DSO with PSA Software:

- Customizable billing rates: Set different bill rates for various tasks, clients, or projects, ensuring precise and flexible billing.

- Automatic approval workflows: Streamline the process of approving timesheets and expenses, reducing administrative delays.

- Mobile access: Enable consultants to log time and expenses on the go, ensuring nothing is missed.

3. Enhanced Reporting and Analytics

Example: A firm leverages PSA software to generate detailed reports on outstanding invoices and payment trends. This data helps the agency identify clients who consistently delay payments and take proactive measures to address these issues.

Best Practices to Shorten DSO with PSA Software:

- Revenue forecasting: Project future cash flows based on current invoices and payment trends to aid in resource planning. Learn more about how you can forecast your project margins.

- Customizable dashboards: Create dashboards tailored to specific metrics and KPIs for real-time financial insights.

- Aging reports: Track outstanding invoices and categorize them by age to prioritize collection efforts.

- Payment trend analysis: Analyze client payment behaviors to identify patterns and address issues early.

4. Improved Client Communication and Transparency

Example: A firm uses PSA software to provide clients with a client portal where they can view project progress, invoices, and payment history. This transparency builds trust and encourages timely payments.

Best Practices to Shorten DSO with PSA Software:

- Online payment options: Integrate with payment gateways to facilitate easy and secure online payments.

- Invoice history access: Allow clients to view their payment history and outstanding balances, improving transparency.

- Client portals: Offer clients a self-service portal to view and pay invoices online.

- Automated reminders: Send automated payment reminders to clients to ensure they are aware of upcoming or overdue invoices.

5. Streamlined Project Management

Example: A firm uses PSA software to link project management with billing, ensuring that invoices are directly tied to project progress. This reduces the risk of underbilling or overbilling, ensuring accurate and timely payments.

Best Practices to Shorten DSO with PSA Software:

- Resource management: Efficiently allocate resources and track task progress to ensure projects stay on schedule and within budget.

- Milestone-based billing: Link billing to project milestones, ensuring clients are billed accurately and timely based on project completion stages.

- Project financials dashboard: Provide a comprehensive view of project financials, helping to manage budgets and forecast revenue.

- Gantt charts and timelines: Visualize project timelines and milestones to keep track of progress and deadlines.

- Budget tracking: Monitor project budgets in real-time to avoid overspending and ensure financial control.

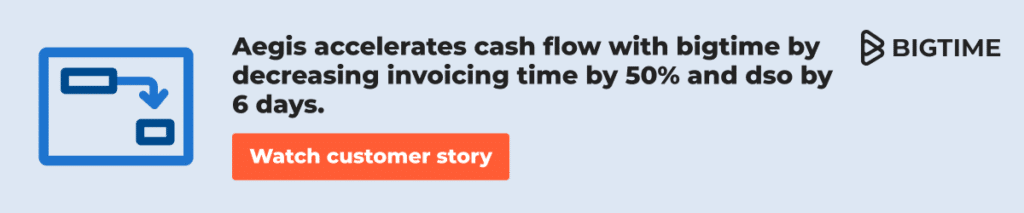

How BigTime Reduces DSO Through Streamlined Billing and Payments

BigTime empowers firms to accelerate their invoicing-to-cash cycle and reduce DSO through robust billing, invoicing, and other payment processing software capabilities:

Efficient Invoicing Process

BigTime enables firms to leverage tracked time and expense data to generate accurate invoices quickly across various billing models. Automated multi-level reviews and approvals ensure error-free invoices, accelerating delivery to clients after project completion, helping clients to pay their invoices on time.

BigTime Wallet for Convenient Client Payments

BigTime Wallet allows clients to securely pay invoices online via credit card, ACH, or wire transfer directly from the invoice email or client portal. Clients can save payment methods for future use and schedule payments aligned with terms, streamlining the collections process.

Automated Payment Reconciliation

Payments made through BigTime Wallet automatically reconcile with respective invoices in the firm’s accounting software like QuickBooks. This seamless integration eliminates manual double-entry, promptly updating accounts receivable.

Client Self-Service and Visibility

The client portal provides visibility into outstanding invoices and payment history. Clients can view, pay immediately, or schedule payments conveniently, reducing follow-ups and associated delays.

Centralized A/R Reporting and Analytics

Customizable A/R dashboards and reporting enable data-driven insights into invoicing, collections, and cash flow forecasting. This visibility empowers firms to identify bottlenecks and make informed decisions to improve DSO continually.

By streamlining invoicing, offering secure self-service payment options, automating reconciliation, and providing financial visibility, BigTime helps professional services firms accelerate cash flow, reduce DSO, and maintain a healthy financial position.

Frequently Asked Questions About How to Reduce DSO

What is DSO?

Days Sales Outstanding (DSO) measures the average number of days it takes a company to collect payment after a sale.

What is a good number for days sales outstanding?

A good DSO is typically 30 to 45 days, but this can vary by industry.

Why do we calculate DSO?

DSO is calculated to assess the efficiency of a company’s credit and collections process and its impact on cash flow.

How can you reduce DSO?

Reduce DSO by improving invoicing accuracy and timeliness, offering convenient payment options, and maintaining clear communication with clients.