If you’re a current government contractor or are planning to work on government contracts, you already know that you need DCAA compliant timekeeping to get the contracts and keep them. Your accounting system needs to comply with Federal Acquisition Requirements (FAR) too. The kind of DCAA compliant timekeeping software you select is important. The right DCAA accounting system combined with DCAA time and expense software can make your contracting process much smoother and contribute to your bottom line.

What are DCAA timekeeping requirements?

A DCAA accounting system audit is going to look at how you keep track of employee or subcontractor time when their work is being billed to a government contract. According to the DCAA’s requirements for contractors, the system needs to support:

- Detailed schedules of labor and overhead rates

- The basis of proposed labor hours

- Staff loading charts

- Accurate, current verifiable timesheets

- Direct vs. indirect contract labor hours

When you’re submitting a proposed contract, the DCAA will give you a pre-award survey to complete, and one of the questions it asks is, “are the loaded hourly labor rates proposed consistent with your established estimating and accounting principles and procedures and FAR Part 31, Cost Principles?” FAR Part 31 principles include 53 subsections: it’s a lot of ground to cover. Fortunately, BigTime’s solution covers the ones necessary for your DCAA compliance time tracking.

You also need to have an accounting system that supports timekeeping that can allocate labor to intermediate and final cost objectives for the project or proposal. And, you need to be able to track indirect and direct costs for each employee and their timesheet.

DCAA also performs real-time labor evaluations. This means they will come on site and will interview employees about their hours and will observe workstations. They’ll reconcile payroll and contract billing and will evaluate timekeeping procedures and your internal controls.

Matching DCAA approved accounting system requirements with reality

Any audit process is designed to confirm that the correct procedures are being used, and the financial information matches contract requirements. In the case of DCAA timekeeping requirements, the audit process is supposed to confirm that your business is following approved procedures for keeping track of time spent on government contracts, including:

- Timesheets should be completed every day

- Timesheets can’t be altered after they’re submitted

- Project numbers and descriptions should be consistent and clear

- Time off and overtime should be accurate

- Different people provide timesheet approvals and payroll authorization (separation of duties)

When timesheets are on paper, it’s very challenging to comply perfectly with these rules. DCAA compliant timekeeping software automates the procedures, reduces the potential for errors, and can integrate smoothly with your accounting system. We’ve put together a guide that covers the requirements for DCAA compliant timekeeping.

How does DCAA timekeeping software help your business meet government timesheet regulations?

DCAA compliant time tracking software provides passwords and personal access to each employee, which meets the requirement for each employee to control and access their own timesheet. It can also produce a clean audit trail that links the timesheets with payroll and your accounting system.

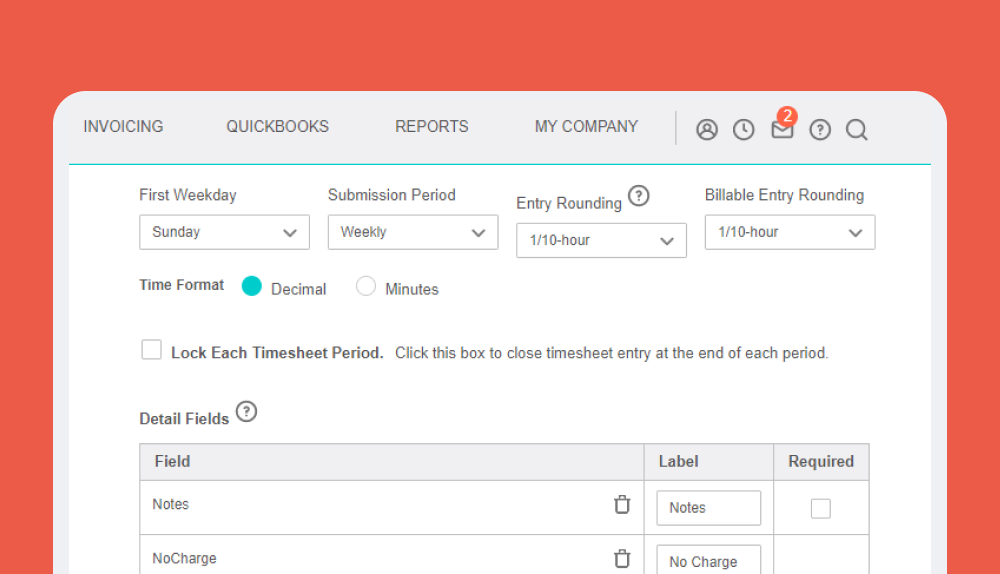

If there are any changes to timesheets, the audit trail needs to include a record of those changes. DCAA timekeeping software should be able to include a notes section that documents and verifies changes and the reasons for them. And, the software should have the ability for timesheet approvals by the appropriate supervisor or manager: and that shouldn’t be the same person who also issues payroll.

Choose DCAA compliant timekeeping software that’s right for your business

Ideally, you’ll want timekeeping software that can automate as many processes as possible. And, timesheet approvals should also be easy and automated, at the same time as they meet DCAA requirements. The software should allow you to review timesheets by employee or by project, and also allow you to assign approval rights that are appropriate for different managers and supervisors. And, the e-signature process should be smooth and easy when it comes time to certify timesheets.

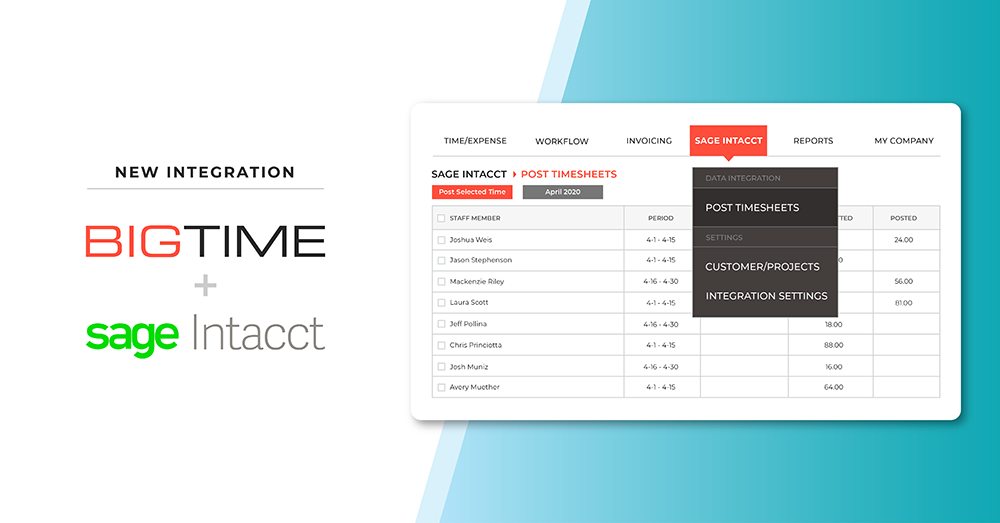

BigTime’s easy-to-use reporting center and dashboard shows you all of the information you need to successfully check every element on the DCAA compliance checklist. It’s also important for your time, billing, and expense tracking software to integrate seamlessly with your DCAA approved accounting system, whether it is QuickBooks or a specific DCAA compliant accounting software system. BigTime will offer you a clean audit trail. But even more important, it will help you to manage your projects and budgets across your entire business, whether you are working on government contracts or commercial projects.

BigTime also gives you the tools you need to train your workforce and support them with automation, so they can keep accurate track of hours. The platform gives you the tech support you need to work closely with managers and employees to ensure that your business isn’t just complying with DCAA timekeeping requirements, it’s managing its time efficiently and effectively. Contact us for a demo and learn how BigTime’s DCAA compliant software solution can save you time, help you to comply with any DCAA audit process, and improve your operations today.