GovCon compliance is easier with a DCAA approved accounting system

BigTime keeps you compliant with enforceable DCAA timesheet restrictions and customizable reports for worry-free audits.

SHOW ME HOW

Track smarter, not harder

Easily log time and expenses with personalized data entry options for your team's individual timesheets.

Bill fast and friendly

Quickly pull together professional-looking custom invoices and send to your clients without the hassle.

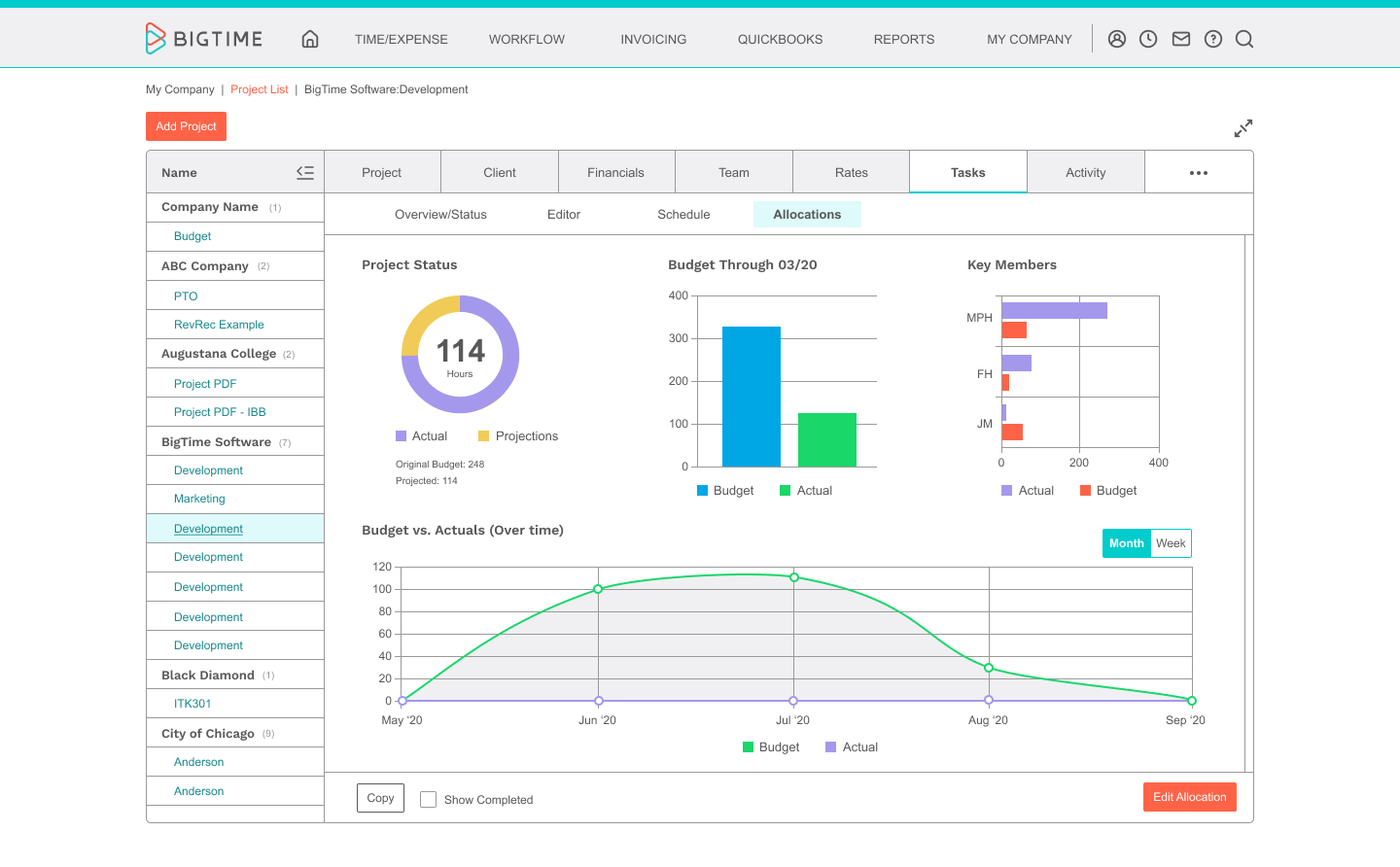

Avoid over/under scheduling

Always have an idea of you who working on what and reduce overall time on the bench.

Keep projects moving

Smoothly handoff work between teams and approval levels with custom workflows.

Plan ahead and on the fly

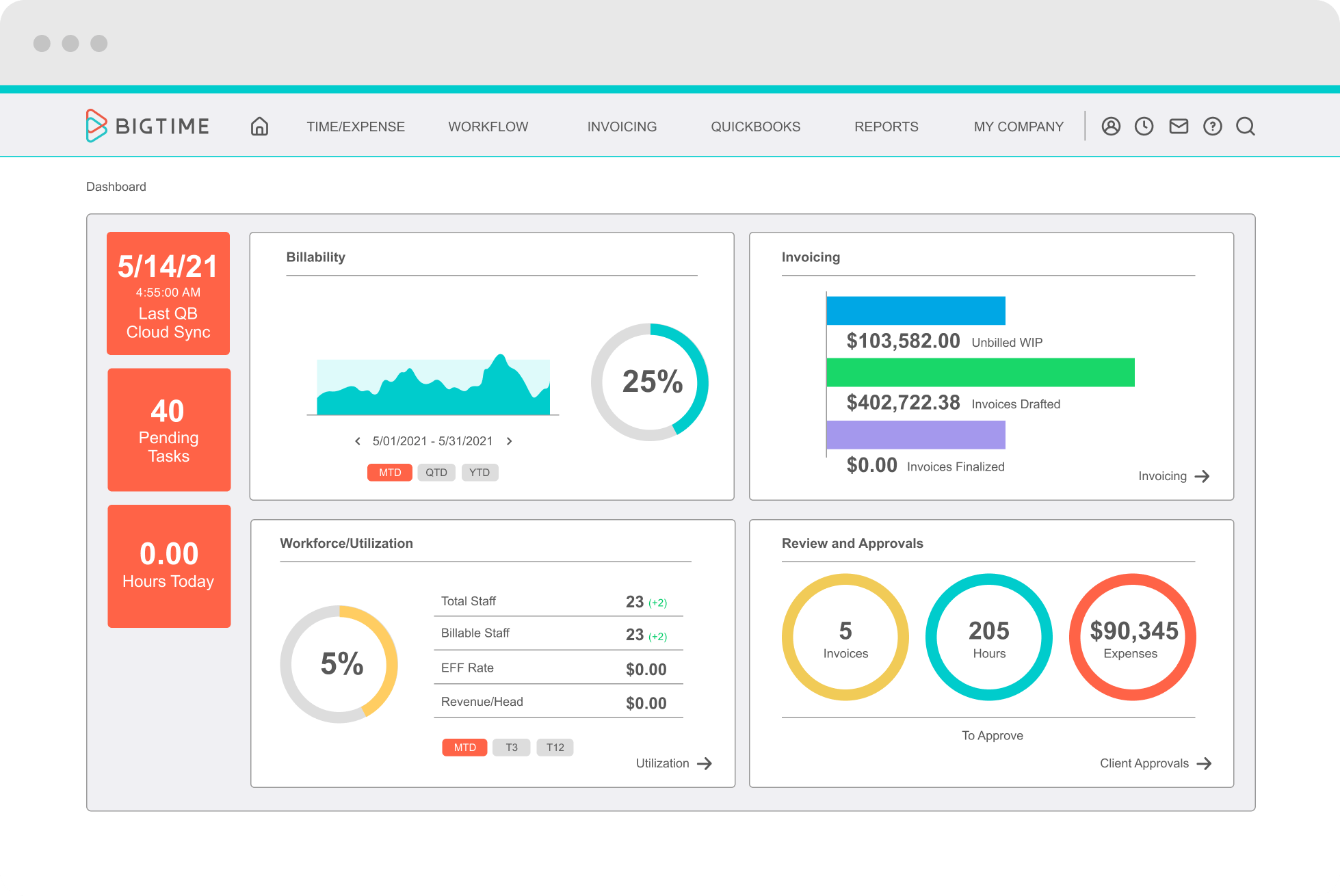

See your plans and analyze progress at a glance with dashboards, analytics, and reporting.

Connect your favorite tools

Seamlessly sync your current software with our deep integrations and full tech support from our team.

Better growth starts here.

LEARN MORE

DCAA Approved Accounting System

Depending on the industry in which you operate, you may need something called a DCAA approved accounting system. The Defense Contract Audit Agency, or DCAA, requires accreditation from certain kinds of businesses, most often those that handle government contracts. If you offer this type of product or service, then you may need a DCAA adequate accounting system, and it is critical for you to familiarize yourself with DCAA approved accounting system requirements. This way, in the event that you ever find yourself in an audit from the Department of Defense (DoD), then you can be sure that your systems are prepared.

Your accounting practices are one of the most important parts of your business, and it is critical for you to keep accurate books for a number of reasons. First, you need to make sure that you are able to pay 100% of your tax liability. Next, so long as you keep accurate books, then you may be able to uncover further tax deductions that may help your business save significant amounts of money. Finally, there is a chance that you may be audited by the government, and if there are any inaccuracies in your books, this could lead to significant fines. As a result, making sure that your accounting system is DCAA approved is an important part of regulatory compliance.

The businesses that need to be prepared for these kinds of audits are those that fulfill contracts for the US Department of Defense (DoD). The Defense Contract Audit Agency (DCAA) is responsible for performing all contract audits related to the DoD. And, given the amount of money that the DoD spends on a regular basis, there are numerous businesses that compete for these contracts on a regular basis.

If you have a company that competes for these lucrative projects - or intends to, in the future - then it is critical for you to make sure you’re keeping up with the latest accounting regulations. When you take the time to focus on the nature and the accuracy of your accounting practices, then you place your company in the best position possible to compete for some incredibly profitable government contracts.

QuickBooks Integration

When you are on the hunt for ways to ensure that your accounting practices are more efficient, then you’re probably looking for integrations that can automate manual processes and eliminate human error from them. Oftentimes, this includes something called a QuickBooks integration. For a long time, QuickBooks has been one of the leading options when it comes to accounting. At the same time, if you are looking for a system that is DCAA compliant, then you may be wondering if QuickBooks is going to meet those strict thresholds.

For those who may be wondering “is QuickBooks a government-approved accounting system,” then the answer is yes: or, at least in most cases. Depending on the exact nature of the QuickBooks version you are using, it is likely to be compliant with DCAA regulations. However, in order to make sure that your particular version of the QuickBooks software program is compliant with the latest regulations from the DCAA, you should still make sure to check with the manufacturer.

DCAA compliant accounting software QuickBooks is a great option to keep your company operating efficiently. When you sync a DCAA compliant timesheet to QuickBooks, then you will be able to save a tremendous amount of time and bother when it comes to your accounting practices. Taking advantage of a DCAA approved accounting system like QuickBooks can help your employees save a tremendous amount of time that can be spent in other areas of the business.

There are a number of major advantages that come with using a DCAA approved QuickBooks integration. First, this integration will be user-friendly, meaning that even someone who does not have a lot of experience with accounting will be able to use the program relatively easily. Second, all of the information is displayed in a convenient place, so that you don’t have to waste time clicking around looking for it. And finally, QuickBooks can also reduce your regulatory risk. Given all of these benefits, which are just a sample of what QuickBooks can accomplish, it should come as no surprise that countless companies rely on QuickBooks for their accounting needs.

DCAA Compliance

One of the most important factors that you need to consider is DCAA compliance. When you are trying to handle DCAA compliance training, it is important to refer to a DCAA checklist. There will be numerous items that should be covered, including the development of both a DCAA compliant payroll as well as DCAA compliant ERP systems.

If you are trying to maintain DCAA compliance, then there are a number of factors you’ll need to consider. First, when you are trying to win a government contract, it is important to make sure that everyone in your company is aware of the rules and regulations set up by the DCAA. Basically, the US government wants to make sure that none of its confidential information will be compromised during its contract with your company, and also that your company’s records are accurate and accessible when needed.

Next, you also need to make sure that you have a clear approval process. Most of the responsibility for time tracking falls on whoever is filling out a daily timecard; however, it is also the manager’s responsibility to make sure that all of the hours their employees are working are accurate. For example, you need to make sure that you track over time on both an employee and a managerial level. If you end up getting audited by the DCAA, then you need to make sure that your overtime hours are reported appropriately. If you are not tracking your overtime hours correctly, then this could place you in serious jeopardy of having a contract placed on hold or canceled.

Besides over time, it is also important to make sure that you are tracking time off accurately. Some of the most common examples of time off include holidays, bereavement, sick days, and vacation. This time off will impact your labor pools, and potentially your delivery schedule and deadlines, so it needs to be tracked appropriately.

Ultimately, in order to remain DCAA compliant, all of your records must be accurate and remain that way. So, make sure that you take a closer look at your record books and ensure they are correct before you try to apply for a DCAA contract.

DCAA Audit Manual

If you are thinking about applying for a DCAA contract, then it is also important to be familiar with a DCAA audit manual. When it comes to a DCAA accounting system audit, it is a good idea to use a DCAA accounting system audit checklist. Using a DCAA audit checklist, you will make sure that you place your company in the best position possible to compete for these lucrative contracts.

However, DCAA audit manual timekeeping is only one of the most important parts of tracking your employees. When you are applying for a government contract, the primary concern is cost. There is a major difference between accounting conducted by a government contractor and accounting conducted by a commercial firm. There are also numerous parts of your company that will be scrutinized during an audit, which include unallowable costs, cost pools, indirect costs, and direct costs, among others. The DCAA will perform a wide variety of audits, and each one will be different. Therefore, it is critical for you to take a look at the audit process on a regular basis and ensure that your company is prepared for scrutiny in these various areas.

DCAA Audit Program

The DCAA audit program is an important part of making sure that companies are in compliance with the latest regulations. If you end up being audited by the DCAA accounting system audit program, there are multiple types of DCAA business system audit that might ensue. For example, the DCAA might decide to conduct a contractor purchase systems review (which is one of the most common types of audit) or they might decide to conduct a compensation and benefits audit. Furthermore, contracting officers might also request an independent financial opinion when it comes to specific elements of your bid. There might even be a process conducted called a pre-award survey, which is usually conducted to ensure that your company has the financial means and appropriate accounting system to handle the project that you are bidding on.

Make sure that you are prepared for all of these DCAA audit programs. When you plan ahead for these potential audits, you will place your company in the best position possible to be successful in its bid for a US government contract.

DCAA Compliance Time Tracking

Ultimately, it is critical for your company to work with a DCAA compliance time tracking software. When it comes to DCAA compliance timesheets, it is important for you to make sure that your timesheets will satisfy the DoD’s requirements. Using a DCAA timecard audit checklist is a great place to start, and from here, make sure you also take a look at your individual DCAA timesheet examples to ensure they are accurate.

It can take a tremendous amount of work to review every individual timesheet for potential inaccuracies, so one of the top ways to avoid this headache is to invest in a software program that can automate this process and others like it. Using a software program that is in compliance with all DCAA requirements can save you a lot of time and stress. Furthermore, by showing the DoD that you are willing to invest in the appropriate software programs, you will also be making sure that your company is as competitive as possible when it comes to bidding on these lucrative contracts.