Government Accounting Software

BigTime allows you to configure timesheets and accounting to meet DCAA compliance requirements for a worry-free audit.

SHOW ME HOW

Track smarter, not harder

Easily log time and expenses with personalized data entry options for your team's individual timesheets.

Bill fast and friendly

Quickly pull together professional-looking custom invoices and send to your clients without the hassle.

Avoid over/under scheduling

Always have an idea of you who working on what and reduce overall time on the bench.

Keep projects moving

Smoothly handoff work between teams and approval levels with custom workflows so you can manage your projects you way.

Plan ahead and on the fly

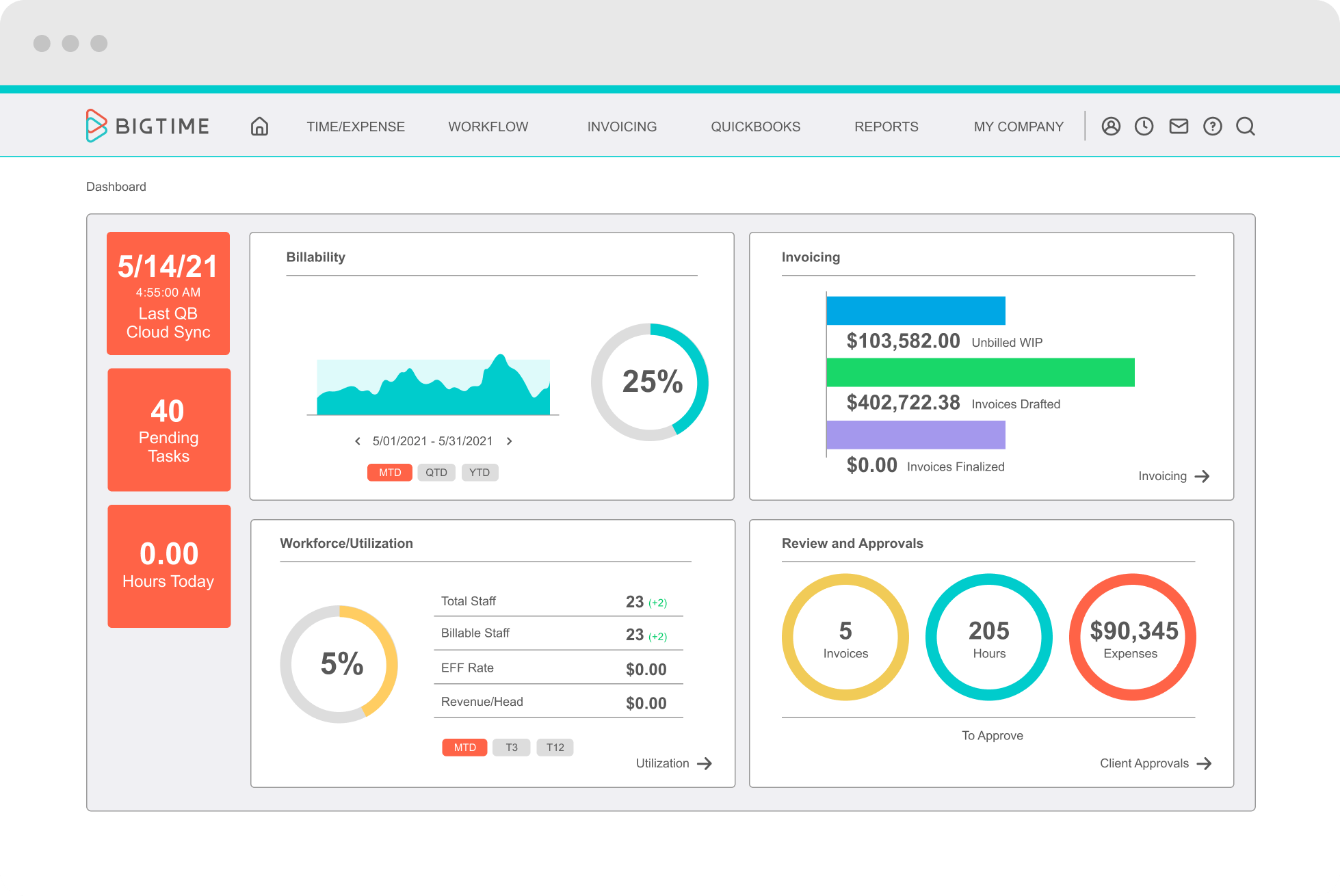

See your plans and analyze progress at a glance with dashboards, analytics, and reporting.

Connect your favorite tools

Seamlessly sync your current software with our deep integrations and full tech support from our team.

Better growth starts here.

LEARN MORE

If you’re a small business that bills hours to the government, you know the importance of tracking your time and expenses to DCAA standards. You need governmental accounting software that will help your process stand up to audits. You’re aware that there are systems such as QuickBooks and Sage Intacct that meet some of the requirements of government software.

BigTime stands out among the government accounting examples. It’s a full-function DCAA-compliant time tracking and invoicing system for professional services organizations. We integrate with QuickBooks and Sage Intacct to provide functionality that meets all the DCAA requirements. When you have BigTime integrated with an accounting system, you can be confident that you have everything you need to successfully pass a DCAA audit.

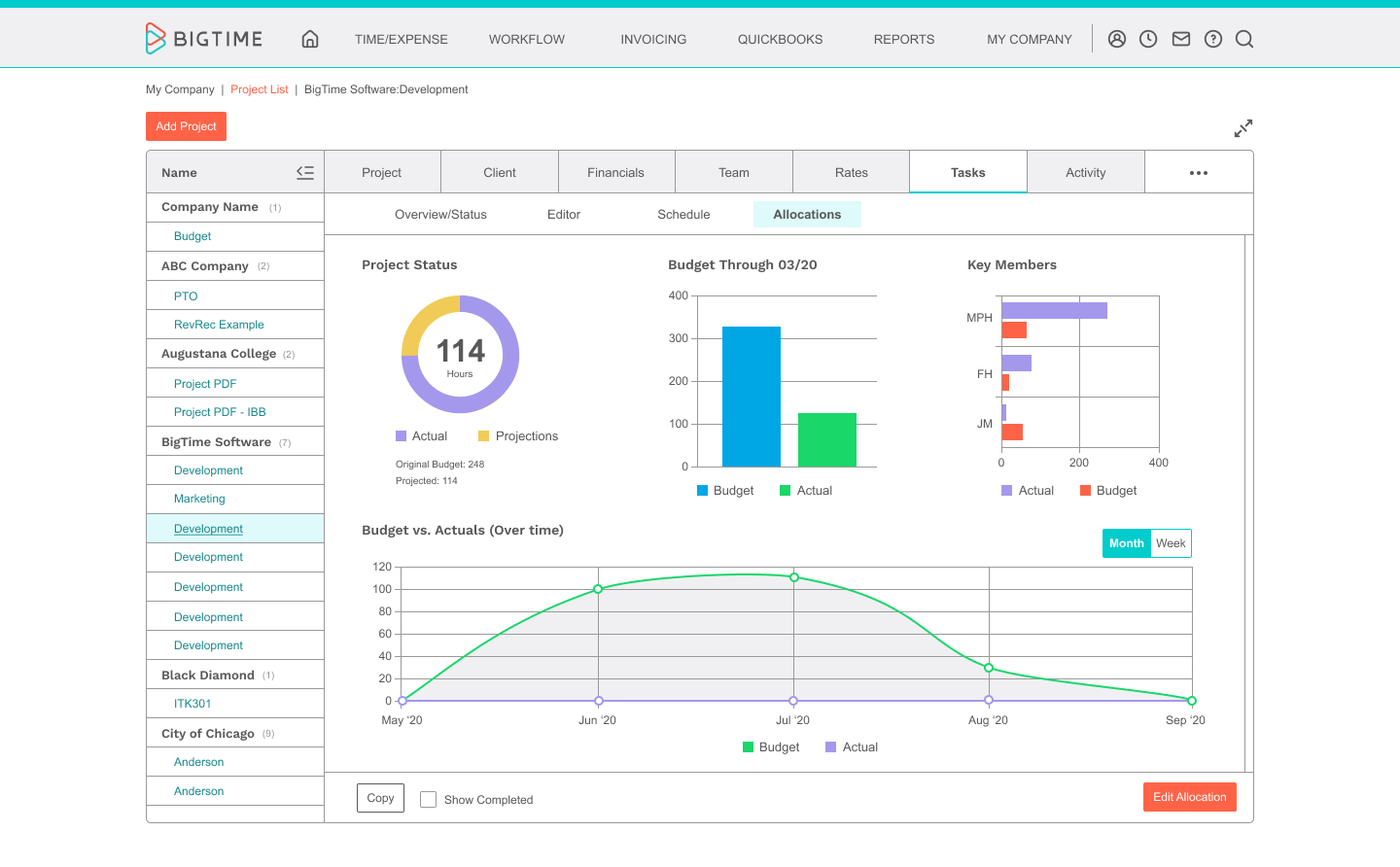

You need the functionality a robust time-tracking system provides. That includes setting up all the correct job codes and assigning them accurately to projects and personnel. It encompasses timesheet restrictions to prevent violations of DCAA standards. With the right system, time can’t be logged in advance, and timesheets are locked once the billing period is complete. Any changes to previously locked timesheets must be approved by authorized supervisors and properly documented.

A good time-tracking system isn’t just a series of screens where you enter hours. It should help you manage your workflows. That includes enabling timesheets and prompting supervisors when they need to review and approve entered time. It includes an enforced process for correcting previous mistakes and getting the revisions approved and documented. The system needs to dovetail with your own organization's procedures and work with your company’s standard best practices.

On top of that, systems like BigTime provide information to help you manage your business. On any project, you can see where you stand with expenses incurred and hours billed. It will be clear if there are roadblocks or bottlenecks that require you to reallocate resources.

Accounting Software for Government Contractors

There are DCAA-approved government accounting system requirements that every government contractor has to meet. Many of these relate to the unique ways that the government requires hours and expenses to be reported. Government software companies should offer you the ability to segregate hours the way DCAA demands.

Whether you have government software contracts or contracts to provide other services to the government, you have to, for example, distinguish between direct and indirect costs. You have to segregate unallowable costs, such as entertainment costs, so that you can track them but not bill them. If you’re using your system as a local government software system, you may not be subject to a DCAA audit, but you’ll still be well-served by having all the capabilities that a DCAA-compliant system requires.

One of the benefits BigTime brings to government contractors is a flexible reporting system. It’s based on the rich store of data in the audit log database, which is fully incorporated into the Reporting Center. It’s easy to see what staff billed what time to which project. You may add your audit log comments to your reports when you need them and leave them out when you don’t. The reporting system gives you confidence that your internal processes are doing what they need to and that the hours you are reporting to the government are accurate and have all the necessary information.

If your system has tracking, billing, and reporting features that were designed with government contractors in mind, it’s easier to be certain that you’ve covered all the bases in your obligation to the government and to DCAA.

Government Billing Software

Billing and invoicing aren’t the only features of a system offered by a government software company, but they’re visible and important ones. The invoices have to be professional-looking, understandable, and accurate. Your billing system should present the information any way the government (or for that matter, any other client) wants to see it. You can put as much or as little information as your government agency wants to see on every invoice.

To keep on the right side of DCAA and to ensure you can pass a DCAA audit, nothing is more important than accuracy in tracking and billing in compliance with DCAA requirements. The right system can assist you with contract setup, funding setup, timekeeping or correct labor distribution. When the DCAA conducts an audit, they want to see that your people are working on what you say they’re working on. You’ll be able to show that that’s the case.

Auditors need to be comfortable that costs are being allocated properly. They have to be assured that you’ve properly segregated direct costs, which can be allocated to a single project, from indirect costs, such as management hours that are billed across several projects. They’ll want to ascertain that you aren’t invoicing any unallowable costs or hours that employees have spent working on non-government projects.

Proper timekeeping for a government account is about as complex as timekeeping can be. With enough work, you can make any billing system do what needs to be done, but a rich system such as BigTime is set up to make it easier to meet DCAA requirements.

Standard Accounting System for Government Agencies

If you’re new to government consulting, the requirements can be a bit overwhelming. How do you know you have adequate software for a federal government contract or even good enough municipal accounting software? What you want is a system that covers the key items on a DCAA compliance checklist.

First off, a good system will enforce all the timesheet requirements. It will force all the required fields to be filled in. It won’t allow time to be submitted for dates in the future. It will lock completed timesheets and ready them for review. It will unlock them only with the proper authorization and documentation.

The best systems will support workflow. The right authorizations will be enforced. The system will inform supervisors when it’s time to act and ensure that all tracking and approvals are orderly.

Reporting is key, not only for accurate billing, but also for internal information. It helps you with budgeting and to ensure that your revenues and expenses are on track.

While integration with your accounting system is not a DCAA requirement, your life will be easier if you have it. Another non-required but helpful feature is accessibility from the cloud or from mobile devices.

Government Management Software

The ideal government management software is DCAA-compliant so it can correctly bill and invoice federal government agencies, but its usefulness doesn’t stop there. The features of a system such as BigTime make it a good fit for all kinds of consultancy practices, not only if your client is a federal agency but also if you’re using the package as state government software or municipal government software.

Any state or municipality is going to have its own requirements, and a system robust enough to be DCAA management software can be municipal management software as well. BigTime is suitable for any business that bills hours, whether those hours are for consultancy, law, architecture, IT or engineering. That’s true whether the system is being used as federal government software, municipal software or private client software.

As government management software, the system is more than just billing software. It assists in the oversight of the entire relationship with the client.

QuickBooks for Government Contracting

QuickBooks is a popular accounting system with small consulting businesses. It has a limited number of features that are compatible with DCAA. It needs enhancements or integrations with other systems to make it DCAA compliant software for small businesses. Even if you’re using QuickBooks for local government, you’ll likely need to build on it to do everything you require.

To build a DCAA-approved accounting system, QuickBooks functions best when integrated with a system like BigTime. You can seamlessly synchronize data between the two systems. Data from QuickBooks will automatically migrate to BigTime. You can also import historical QuickBooks timesheet and invoice history to BigTime. Service and expense codes can be linked without any redundant data entry. Timesheets and expenses can be posted back and forth, and either system will generate your invoices for you.

It’s a challenging task to make QuickBooks do everything DCAA requires, but when you integrate your accounting system with BigTime, you achieve compliance a lot more easily.

Government Accounting Software Free Download

Who doesn’t like free? Even a casual internet search will find you an assortment of free government accounting software options, including everything from Excel templates to small-vendor systems that provide free accounting software for PCs.

One thing to keep in mind is that with free accounting software, only the initial purchase is free. There’s a cost to installing it, figuring out how to use it, maintaining it, modifying it, and ensuring that it’s DCAA compliant. You may find that you’re constantly adapting your business and your procedures so they will work with your accounting package.

BigTime isn’t free accounting software, but we offer a free trial. Rather than spending your time and energy on something that’s free but may not offer all the functionality you need, why not investigate how a more sophisticated software package can make your life better. You'll discover benefits you never would have found with your free billing package.