Is your internal invoicing process taking a toll on your professional services firm’s profitability? If so, it’s time to take a closer look at what it’s costing you. Inefficient invoicing processes can lead to wasted time, increased manual labor, and even lost revenue due to errors or delays. By understanding the impact of your internal invoicing process, you can identify areas for improvement and streamline your operations for increased efficiency and profitability.

By assessing the costs associated with internal invoicing, businesses can uncover opportunities to minimize expenses, enhance productivity, and improve the organization’s overall financial health. In this article, we’ll explore the hidden costs of internal invoicing processes and provide insights into how businesses can minimize these expenses.

The Hidden Costs of Invoicing With Outgrown Processes

Along with being a pain for you, your team, and your clients, an inefficient invoicing process can be like flushing your hard-earned money down the drain. By understanding the common hidden costs associated with not having a proper internal invoicing process, firms can take proactive measures to streamline their internal invoicing processes, minimize inefficiencies, and optimize their financial and operational performance.

Keep on reading to discover the associated hidden costs of invoicing when no internal process is implemented.

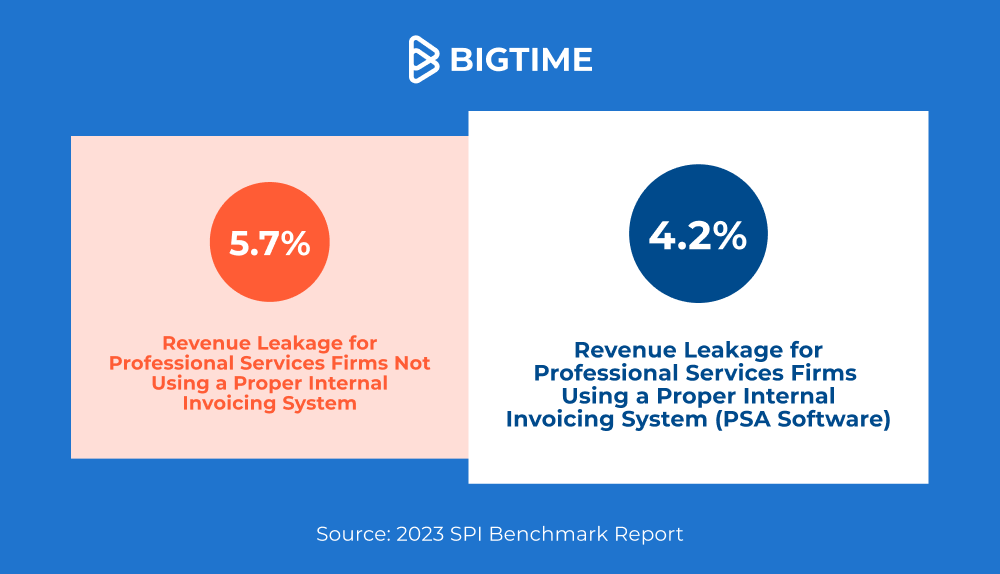

Revenue Leakage

Revenue leakage is a significant concern for professional services firms. It occurs when billable work and expenses are not properly documented, tracked, or invoiced. Accurate and timely invoicing acts as the last line of defense against revenue leakage by ensuring that all billable work, expenses, and changes are meticulously tracked and billed.

Here’s how an inefficient invoicing process can impact revenue leakage:

Unbilled Services

Tasks and hours worked on client projects may not be accurately recorded or billed, leading to a direct loss of revenue.

Underbilling

Even when services are invoiced, they may be underbilled due to inaccuracies in time tracking or a lack of visibility into additional billable details, like expenses or change orders.

Client Dissatisfaction

When clients discover discrepancies in their invoices, it can result in dissatisfaction and strained client relationships, possibly leading to reduced repeat business.

Profit Decline

Over time, revenue leakage accumulates, hurting profit margins and limiting a firm’s ability to invest in growth and innovation.

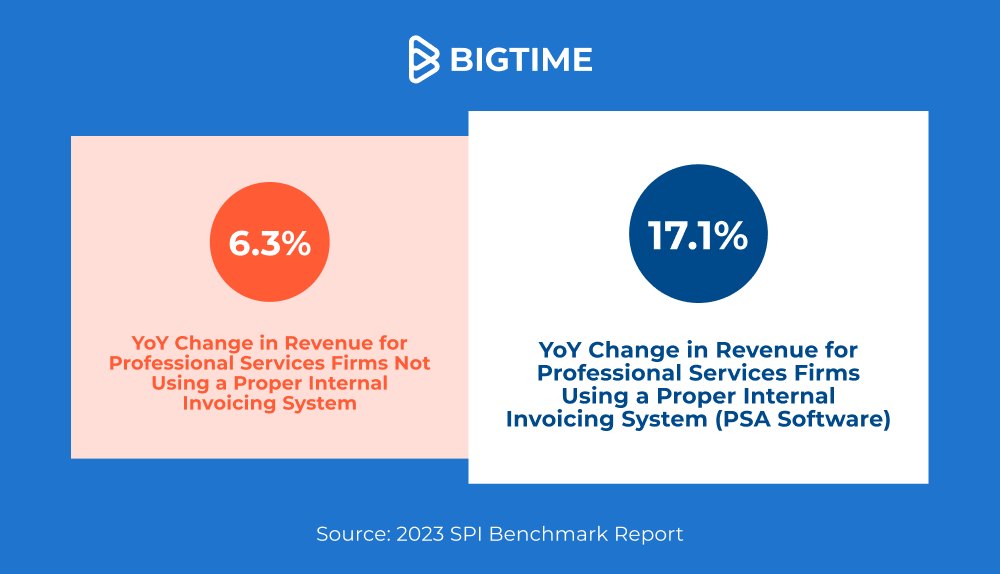

Year-over-Year (YoY) Change in Revenue

Inefficient invoicing systems can disrupt accurate YoY revenue analysis by introducing inconsistencies and inaccuracies into financial data. On the other hand, a well-structured internal invoicing system ensures reliable and consistent revenue data, empowering firms to scale by making informed strategic decisions based on accurate historical performance.

Here’s how an inefficient invoicing process can impact YoY change in revenue:

Inconsistent Data

Without a well-organized internal invoicing system, revenue data might be inconsistent, making it challenging to compare performance across different years.

Strategic Decision Making

Inaccurate YoY revenue comparisons can mislead decision-makers, leading to suboptimal strategies and investments.

Growth Planning

Reliable YoY revenue data is essential for effective growth planning and identifying market trends. Inaccurate data can hinder a firm’s ability to seize growth opportunities.

Days Sales Outstanding (DSO)

Days Sales Outstanding (DSO) measures the average time it takes for an invoice to turn into payment and is a critical financial metric. An inefficient invoicing process can substantially elongate DSO by causing delays in invoice generation and delivery to clients. This not only strains a firm’s cash flow but also affects its capacity to invest in new projects, meet financial obligations, and make optimal use of working capital. A good internal invoicing system expedites the creation and distribution of invoices, resulting in shorter DSO periods, improved cash flow, and enhanced financial flexibility for the firm.

Here’s how an inefficient invoicing process can impact DSO:

Delayed Invoice Generation

Without an effective invoicing system, invoices may be delayed in being generated and sent to clients, prolonging the time it takes to initiate the payment process.

Delayed Payments

Extended DSO can strain a firm’s cash flow, making it difficult to meet financial obligations, invest in new projects, or cover operational costs.

Opportunity Cost

The longer it takes to collect payments, the more a firm misses out on the opportunity to use that capital for growth or investment.

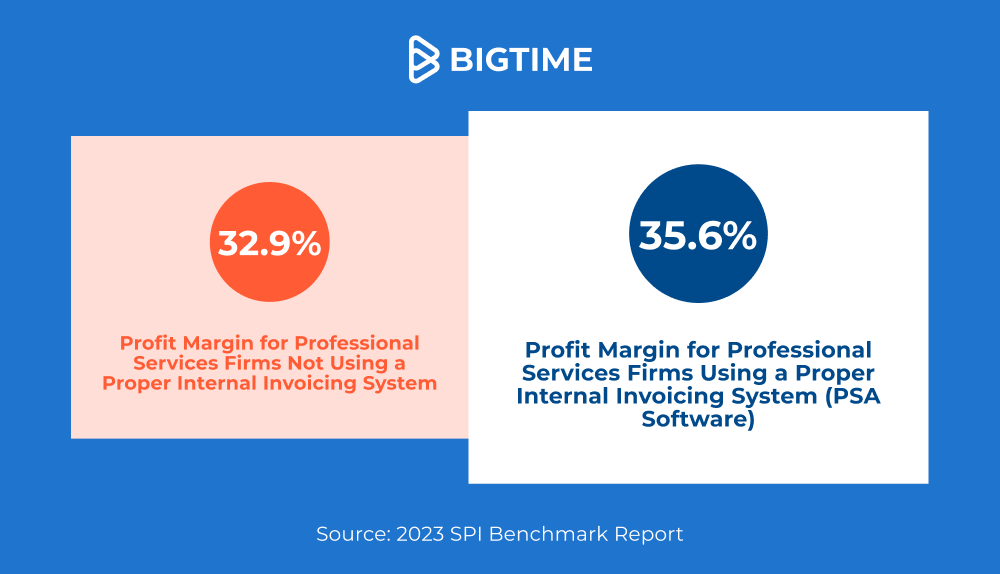

Profit Margin

Profit margin is a key indicator of a professional services firm’s financial health as it reflects their financial performance and impacts their ability to thrive, invest, and remain competitive in the market. An ineffective invoicing process not only diminishes revenue but also results in heightened operational costs and resource mismanagement, ultimately impacting the firm’s profit margins.

Here’s how an inefficient invoicing process can impact profit margin:

Inaccurate Billing

Inefficiencies in invoicing can lead to inaccuracies in client billing, including missed billable hours, incorrect rates, or other invoicing errors. These inaccuracies can result in underbilling or overbilling clients, which directly affects the revenue a firm collects. Underbilling means the firm fails to capture the full value of its services, while overbilling can lead to client disputes and potential refunds, both of which affect profitability.

Resource Allocation Issues

Inaccurate invoicing can misrepresent the firm’s financial performance, leading to misguided resource allocation decisions. The firm may invest in areas that are less profitable or neglect opportunities for growth, affecting profit margins by reducing resource efficiency.

Operational Costs

Correcting invoicing errors, addressing disputes, and following up on overdue payments all require additional resources and operational costs. These costs can further reduce profit margins, as they are incurred in the process of rectifying invoicing-related issues.

How to Keep Your Invoicing Process Profitable With PSA Software

Maintaining a profitable invoicing process is crucial for the success and growth of your company. One powerful tool that can significantly contribute to your profitability is Professional Services Automation (PSA) software. PSA software like BigTime Software empowers firms like yours to not only address the challenges and hidden costs of internal invoicing but also optimize processes for enhanced profitability, operational efficiency, and so much more.

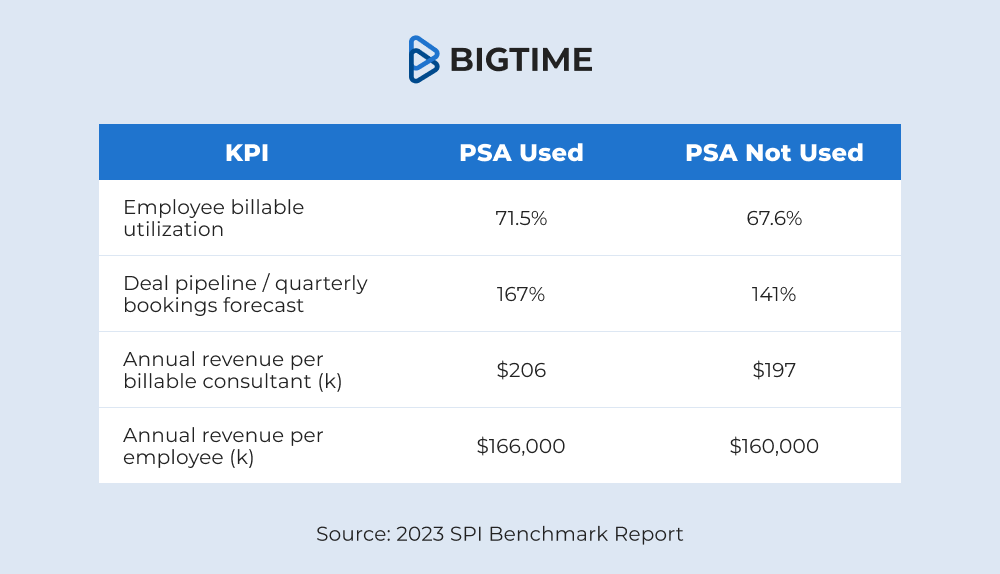

To better understand the impact of PSA software, let’s take the annual revenue per employee example above increasing by $6,ooo. If you have 50 consultants on your team, that’s an additional $300,000 in revenue each year just from the support of PSA software.

Here’s how PSA software contributes to maintaining profitability in the invoicing process:

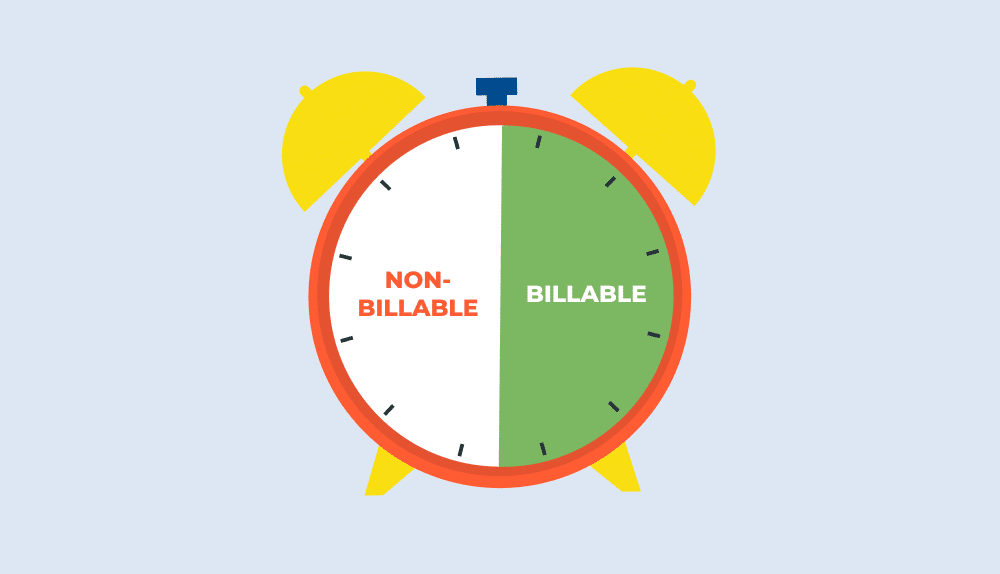

Accurate time tracking gives you access to a real-time look at billable hours. This ensures that no billable time is lost or incorrectly recorded, reducing the risk of underbilling and revenue leakage. Accurate time tracking is essential for billing clients correctly and optimizing revenue.

Effective project management helps projects get completed on time and within budget. This prevents cost overruns and the need to write off unbillable hours, which can negatively impact profitability.

Automated invoicing makes it faster and more efficient. Invoices can be generated with greater accuracy and consistency, reducing the chances of invoicing errors that could lead to disputes or long DSO.

Efficient resource allocation ensures that the right people are working on the right projects, at the right time — maximizing billable hours and reducing waste of resources, ultimately contributing to higher profit margins.

Expense tracking makes sure all reimbursable expenses are accurately captured and billed to clients. This minimizes the risk of unclaimed expenses that can negatively impact profitability.

Reporting and analytics provide valuable real-time insights. Firms can analyze their financial data, including revenue, expenses, and profit margins, to make informed decisions for future growth and profitability.

Speed Up Cash Flow by Invoicing Through BigTime Software

BigTime’s billing and invoicing software is a powerful and user-friendly solution designed to streamline the financial aspects of businesses and beyond. Our robust features allow users to easily create, customize, and send invoices, track billable hours, and manage expenses, making it an indispensable tool for efficient and accurate financial management. Our payment processing software, BigTime Wallet creates an easy client payment experience, and as a result, gets you paid faster. But don’t just take our word for it…