Last updated May 2nd, 2023

Payment processing is a crucial aspect of any business, but it can also be a source of frustration and challenges. From security concerns to technical issues, there are many payment processing challenges that can plague a professional service business. That’s why we’ve compiled 5 of the most common issues businesses face, and tips on how you can avoid them.

Payment Processing Challenge #1: Lack of Transparency

The myriad different pricing tiers and options make payment processing increasingly difficult for business owners to understand what they’re actually paying for. On top of that, many processors have hidden fees and charge for additional line items not initially disclosed to the business. Higher fees can also be incurred as a business grows. Combined, these fees are one of the most common reasons for complaints regarding online payment processing services for businesses.

How to avoid it:

Investigate if the business has different prices for different kinds of cards. In a tier-based pricing system, similar transactions are grouped and put into tiers, and each tier is charged a different fee. Depending on the type of transaction, you may be spending up to 4% on processing.

Try to steer clear of this pricing model and opt for flat-rate pricing options whenever available. Flat rate pricing removes the uncertainty that plagues business owners because there is a fixed monthly rate, so businesses know exactly what they’re paying for each month.

Payment Processing Issue #2: High Processing Fees

Another thing to watch out for when considering a payment processing solution is high processing fees. Business owners work hard for their success, and paying exorbitant transaction costs can decrease their earnings and make it difficult to stay ahead of the competition. And most have no idea what they’re paying for in credit card processing, resulting in them paying high fees without realizing it.

How to avoid it:

The first step in avoiding paying inordinate amounts in processing is to understand the breakdown of different fees. All businesses must pay certain unavoidable fees:

- Interchange – the fee charged by credit card companies like Mastercard and Visa for businesses to accept their cards – set by the credit card brands.

- Transaction fees – these fees are associated with each transaction run.

Here are some additional payment processing fees you should watch out for:

- PCI compliance

- Setup fees

- Account maintenance fees

- Statement fees

How to avoid it:

Be aware of what to look for, and steer clear when you see extra fees noted. Choose flat-rate processing so you know exactly what you are paying for and avoid paying varying amounts for different card types. Beware of what fees are necessary by being proactive and exploring your options so you can make the determination.

Payment Processing Problem #3: Fraud and Chargebacks

While online payments have added a layer of convenience, they have also opened up concerns of information security. Simply put, online payment processing increases the risk of information theft. In fact, according to a 2014 report by Symantec, about 60 percent of cyber attacks targeted small and medium businesses with fewer than 2,500 workers. Small businesses are extremely vulnerable to cyber fraud and your business must protect your customers from fraudulent credit card transactions.

How to avoid it:

Make sure your business is PCI compliant and protected against fraud. Choose a company that provides support for PCI compliance. For example, BigTime helps its users become PCI compliant within 60 days of signing up for payments, avoiding the penalty fees charged by the credit card brands.

Chargebacks can be prevented by providing clear and accurate descriptions of your services and working to resolve customer complaints promptly. It’s also important to keep accurate records and documentation to dispute any fraudulent chargebacks. These steps can help reduce your risk and protect your revenue.

Payment Processing Challenge #4: Lack of Support

With a growing number of customers requiring payment processing, it’s not uncommon for some processing solutions to only provide the highest level of support to their most profitable businesses. When things go wrong, businesses need to know that they are taken care of and will be able to resolve their queries effectively. However, due to the high volumes of support queues and a growing number of businesses using credit cards, it’s not uncommon for support to be delayed.

How to avoid it:

Find a company that has around-the-clock support and systems in place to answer your queries so you can operate your business at peak efficiency. Look for companies that offer dedicated, reliable, and timely support – via chat, email, and phone. A good way to see if a company offers this is by looking for online payment processing systems with a reputation for excellent customer service and support. One way to do this is to look at company reviews on sites like G2 and Software Advice.

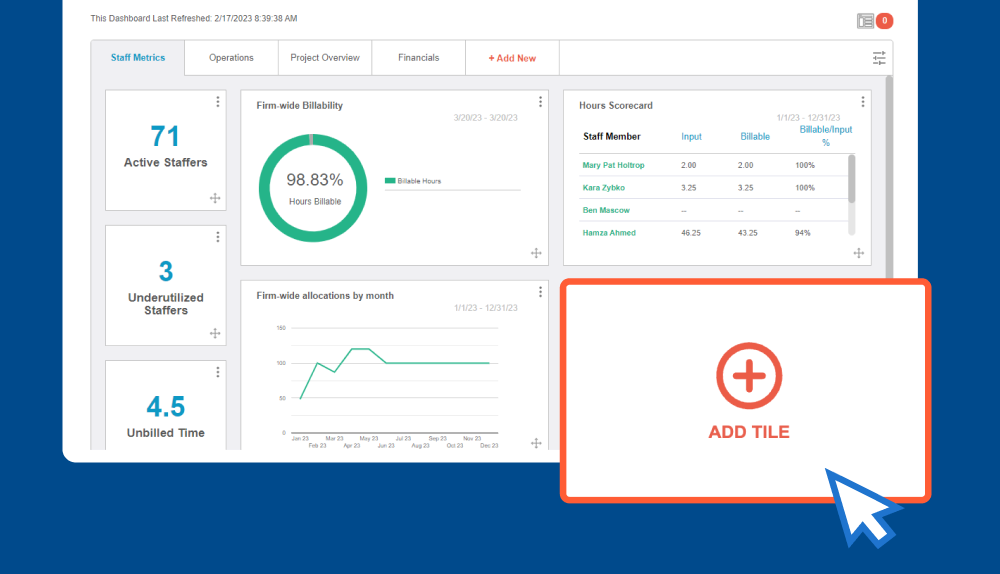

Payment Processing Issue #5: Lack of Integration

If you are currently using software to manage your business, you may not want to use an entirely different system just for online payment services. As a business owner, your main priority should be to optimize your operational efficiencies, and working from two different systems results in a disjointed experience. It may also take you longer to gain insights into your business when you’re working from two different systems.

How to avoid it:

Look for business payment processing systems that offer seamless integration with your other professional services software. For example, BigTime provides you with a unified project accounting and project management software that has integrated payment capabilities. This way, you never have to leave the comfort of BigTime to access other tools – it’s all in one place for a streamlined and more efficient process!

Summary

Online payment processing for small businesses to large organizations is an important aspect of operations and can have a significant impact on the financial health of a business. It’s imperative to choose the right payment processing system that meets the specific needs of your professional services firm.

Five common payment processing challenges faced by professional service businesses include:

- Lack of transparency in pricing

- High processing fees

- Fraud and chargebacks

- Lack of support

- Lack of integration with other business software

While payment processing challenges can be daunting, taking the time to evaluate and implement the best payment system for your company can help take some of the pain out of the process. Explore BigTime’s Wallet feature to discover how it can help eliminate challenges when it comes to online payment processing for small businesses to large businesses. Request your personalized demo to learn more.

This post was written by Aliza Sharma, Partner Associate at Stax by Fattmerchant.

Frequently Asked Questions About Payment Processing Challenges

What are the top challenges companies have with processing payments?

Five common payment processing challenges experienced by businesses include:

- Lack of transparency in pricing

- High processing fees

- Fraud and chargebacks

- Lack of support

- Lack of integration with other business software

How can I improve my payment processing?

Professional services businesses can improve their payment processing by taking steps such as:

- Opting for flat-rate pricing options whenever available to know exactly what you’re paying for each month.

- Understanding unavoidable charges and watching out for additional payment processing fees such as setup fees, maintenance fees, and statement fees.

- Choosing a company that provides support for PCI compliance.

- Evaluating software options on review sites such as G2 and Software Advice to find the features and support you need, as well as customer satisfaction ratings.

- Implementing a system that seamlessly integrates with other business software for optimized operations.