For professional services firms, profitability is a primary goal. In a world where technology has automated many of the tasks once performed by humans, it’s especially important to make sure that every minute billed is actually contributing to the bottom line.

Revenue leakage occurs when a services organization often unknowingly loses earned revenue. If you don’t have clear and transparent visibility into consultant invoicing and revenue-generating processes, it can be hard to proactively manage them and accurately measure the performance of the services delivered.

In this article, we will dive into what revenue leakage is, how it can occur, and seven ways you can plug it to ensure earned money is realized.

What is Revenue Leakage?

Revenue leakage is the difference between the amount of money earned and the actual amount collected. It’s a measure of how much money is essentially left on the table, and there can be a variety of causes of revenue leakage:

- Manual accounting processes and/or outdated systems

- Clients not being billed as frequently as possible

- Pricing services at a rate too low to cover costs

- Clients not paying their bills in a timely manner

- Lack of follow up with late payers to collect outstanding debts

- Lack of communication with clients related to payment terms and timing

- Inefficient or ineffective billing processes

- Inaccurate or incomplete invoices

- Poor revenue forecasting methods

How to Prevent Revenue Leakage

Now that we understand what revenue leakage is and what can cause it, the next crucial step is understanding how to prevent revenue leakage at an organization. To plug revenue leaks in your services business, start with these 7 tips:

Tip 1: Manage Project Slippage and Time Write-Offs

Slippage is when a project takes longer than expected, and time write-offs are when a customer refuses to pay for some amount of hours, commonly associated with projects finishing past their scheduled completion date. These risks can be proactively managed by clearly defining deliverables and timelines up front, so that everyone is on the same page about what’s expected. Tracking an estimate-at-completion against the budget can be a good early warning signal for projects running over budget and will alert project managers when a specific aspect of a project is expected to take more effort than what was budgeted.

Schedule regular check-ins with clients to review progress and potential challenges; keep an eye out for signs of slippage or trouble (such as being late on payments); and track your internal metrics closely so that you can catch any issues early enough before they become systemic problems.

Tip 2: Include Zero Dollar Time and Cost Cards on Consulting Invoices

Include zero value time and cost cards on actual, issued professional services invoices. While this may seem unnecessary, by taking all cards through the entire process, you ensure that the correct amount was charged to the customer at all levels. If a resource sets the wrong rate on a card, the project manager may catch it on approval or the finance team may catch it during the consultant invoicing process.

Tip 3: Create and Maintain Accurate Project Rate Cards for Revenue Leakage Control

Often referred to as “rack” rates, keeping standard rates up-to-date is good best practice. Additionally, if your organization works from more than one rate card (Projector by BigTime’s customers frequently have multiple rate cards, sometimes even on a single project). Updated and accurate rates allow for easy benchmarking and reduce the risk of revenue leakage from mistakes that may occur during project setup and invoicing.

Tip 4: Automate Time and Expense Tracking

As a professional services firm, you know the importance of time and expense tracking. However, if your team is spending their time documenting their activities and expenses manually, it’s hurting your bottom line. Automated time and expense software helps resources and management get more done in less time, allowing the opportunity to be more productive and efficient so that you can focus on what really matters: growing your business profitably! Automating processes related to revenue leakage, like time cards flowing seamlessly to invoices, optimizes profitability and reduces administrative overhead.

Automating time and expense entry processes is made easy by using a tool like professional services automation (PSA) software. This type of tool, purpose-built specifically for professional services, reduces revenue leakage by capturing every hour worked and every dollar spent to deliver projects for clients. Administrative staff can also set up automated alert notifications to remind consultants to enter time and expenses as another step toward preventing lost or delayed revenue.

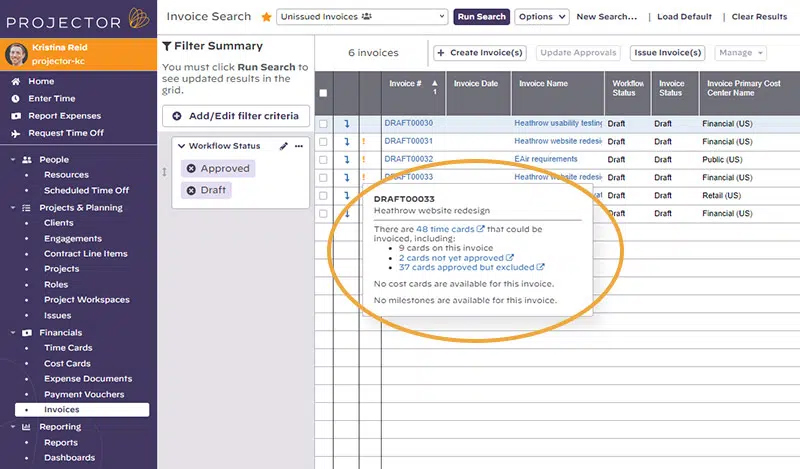

When utilizing revenue leakage software capabilities like the ones in Projector by BigTime, you can get alerts for time cards that are in draft, rejected, and submitted status that are associated with a given invoice. This prevents further revenue leakage by bringing time cards to your attention that can potentially be included on a project invoice. In addition, if billable items get added to a specific date range after an invoice is created, users will see a warning on the invoice window that flags items that possibly belong on that invoice as well.

Projector by BigTime helps prevent revenue leakage with alerts for any time cards that are in draft, rejected, and submitted status associated with a given invoice, bringing attention to time cards that can potentially be included on an invoice.

Projector by BigTime helps prevent revenue leakage with alerts for any time cards that are in draft, rejected, and submitted status associated with a given invoice, bringing attention to time cards that can potentially be included on an invoice.

Enabling your team members to track their hours and expenses directly from their computer or mobile device eliminates the hassle of manual data entry at the end of each week and reduces errors related to time entry. There are a variety of options available for services firms to automate these business processes, including time tracking point solutions, project management tools, and professional services automation (PSA) software—which leads us to Tip 5.

Tip 5: Utilize Technology as a Tool to Reduce Revenue Leakage

Many professional services firms use paper-based systems and/or Excel spreadsheets for tracking billing and expenses, especially if they are at the early stages of service maturity levels. Using this method, organizations are often unable to get accurate reports on how much their employees are working or the costs associated with that work, because these records are not organized in an effective and efficient format.

Managing billable time and the nuances of professional services operations requires good data collection systems. Systems range from point solutions (such as a time and expense tool) and project management tools to more advanced options like PSA software for organization-wide efficiency improvements. Organizations looking for a tool to support efforts to reduce revenue leakage should look for best-fit professional services software that will help manage financial processes by providing automated invoicing capabilities, time and expense tracking, payment reminders, and accounting functionality for revenue recognition.

The best software for your organization will depend on your size, budget, business goals and needs. Whichever tool you choose, be sure that it can integrate seamlessly into other tools the company is already using in its technology stack and that it solves the issues that need to be addressed.

Another significant benefit of implementing a technology solution leads us into Tip 6, which is using data and project analytics to measure and improve performance.

Tip 6: Use Revenue Leakage Analytics Data to Measure Improvement

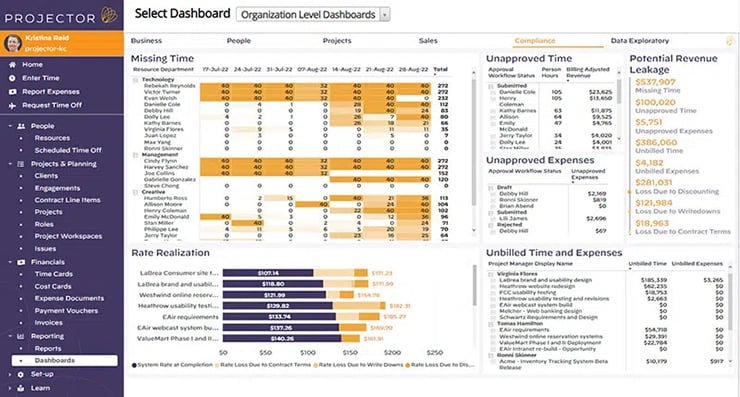

Services delivery and operational performance need to be measured, starting with how much revenue leakage is affecting your services business (i.e., how much money is being lost because it could not be billed). This means identifying which projects and/or clients are causing this problem, where exactly the leakage occurs, and whether it’s happening at pre-billing stages or post-billing stages.

Projector by BigTime makes it easy to quickly view potential revenue leakage and pinpoint the cause to ensure revenue earned is received.

Projector by BigTime makes it easy to quickly view potential revenue leakage and pinpoint the cause to ensure revenue earned is received.

Analytics is a powerful tool that you can use to monitor performance over time, identify areas that need attention, and predict trends and future performance to forecast where revenue may not be realized. As you make changes based on the insights you get from your revenue leakage analytics, keep an eye on how your performance improves over time. Red flags would be any sudden dip in revenue or an increase in customer churn rate.

When you use a tool like PSA software with advanced project data analytics and business intelligence capabilities, you can quickly view nuanced revenue data across your organization to identify revenue leakage through sales, accounting, and project processes. It’s easy to think that you’ve done everything right when you’re growing your business, but you might be surprised at how quickly lost hours can add up if financial leakage creeps in and progress isn’t being tracked.

Tip 7: Create a Plan for Going Forward

Once you have identified your most problematic areas of internal weakness, whether it is poor project scoping and SOWs, delayed time entry, or project timelines slipping, create an action plan on how best to address those issues. And keep monitoring and measuring to know your plan is working!

Summary

In summary, revenue leakage is the money earned by a services organization minus the amount collected. This loss of revenue can become significant if it continues to go unnoticed and the causes of revenue leakage aren’t corrected. The key to minimizing revenue leakage is taking a proactive approach to managing billable time and expenses and operational processes using automation and analytics. PSA software like Projector by BigTime is purpose-built to help services organizations tackle this approach and streamline services delivery to maximize growth and profits.

If you’re struggling to keep your firm’s revenue flowing in smoothly, contact our team today to see how BigTime Software can help you implement all of these tips to decrease revenue leakage, improve project profitability, and generate more revenue per consultant.

Frequently Asked Questions About Revenue Leakage

What is revenue leakage?

Revenue leakage refers to the difference between the amount of money earned and the actual amount collected.

What are causes of revenue leakages?

There can be a variety of causes of revenue leakage, including:

• Manual accounting processes and/or outdated systems

• Clients not being billed as frequently as possible

• Pricing services at a rate too low to cover costs

• Clients not paying their bills in a timely manner

• Lack of follow up with late payers to collect outstanding debts

• Lack of communication with clients related to payment terms and timing

• Inefficient or ineffective billing processes

• Inaccurate or incomplete invoices

• Poor revenue forecasting methods

What is leakage in consulting?

Revenue leakage in consulting or a professional services organization is a term used to describe lost revenue, which oftentimes goes unnoticed.

What is the problem with revenue leakage?

If you don’t have clear and transparent visibility into consultant invoicing and revenue-generating processes, it can be hard to proactively manage them and accurately measure the performance of the services delivered—resulting in delayed or lost revenue.

How do you improve or fix revenue leakage?

It’s critical to plug current leaks at your organization and prevent potential ones from starting to drip in the future. To improve revenue leakage in your services business, start with these 7 tips:

1. Manage slippage and time write-offs

2. Include zero dollar time and cost cards

3. Create and maintain accurate rate cards

4. Automate time and expense entry

5. Utilize technology as a tool

6. Use revenue leakage analytics to measure improvement

7. Create a plan for going forward

How do you calculate revenue leakage?

Revenue leakage is the money earned by a services organization minus the amount collected.

How do you find revenue leakage?

By using a technology solution with revenue leakage software capabilities, you can quickly view nuanced revenue data across your organization to identify revenue leakage through sales, accounting, and project processes. This means identifying which projects and/or clients are causing this problem, where exactly the leakage occurs, and whether it’s happening at pre-billing stages or post-billing stages.

.png)