Understanding Project Profitability Analysis and Rate Realization

Two of the most useful systematic constructs that project delivery organizations can use to understand their business are project profitability analysis and rate realization. Both are project accounting focused views of the health of an organization, delivering information at a granular level to inform better delivery management, better employee management and organizational performance.

A major strength of professional services automation (PSA) tools is the granular analytical reporting capability that can be used to determine profitability of cost centers, clients, engagements, projects, resources, locations, time periods, and many other factors. Profitability analysis allows managers to use financial and scheduling data to understand how profitable the ongoing operations of an organization are. Rate realization is easily handled by PSA software, blending utilization and rates to understand whether the potential for earning was achieved.

Here’s a look at how to measure and manage these concepts.

What is Project Profitability?

Project profitability analysis is a major analytical construct that can be easily achieved using project profitability software such as a PSA system. This analysis compares the revenue generated by doing work for a client (actual revenue) vs. the cost to the organization for delivering those services (salaries and other direct costs). While rate realization analysis concerns itself with comparing actual earnings with earning potential, project profitability is concerned only with comparing actual earnings vs. the cost of generating that revenue:

Project profitability can be expressed in terms of:

- Profit – i.e., the amount of revenue left over after accounting for costs.

- Margin – i.e., the profit compared to the revenue, expressed as a percentage.

Project Profitability Metrics

Like every business, understanding cost accounting and cost-volume profitability at a business level is critical. For services organizations, where resource salaries are often the largest project cost, understanding the profitability of individual projects is essential. We think about two methods for calculating profit and margin:

- Resource Profit/Margin – Profitability calculated by computing costs, based only on resource direct costs (or put another way, the cost to employ people including their salaries, health insurance and all other related costs).

- Project Profit/Margin – Profitability calculated by computing costs based on resource direct costs and any other direct costs.

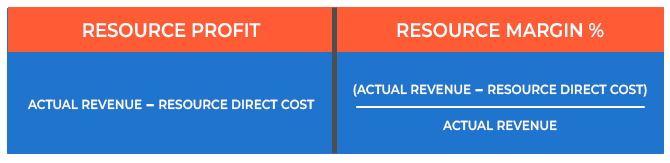

Resource profit and resource margin are calculated as follows:

The direct cost (salary) plus the loaded cost (benefits, overhead, etc) of an employee is used to define the Resource Direct Cost

Project profit and resource margin are calculated as follows:

- Project Profit = Actual Revenue – Resource Direct Cost – Other Direct Costs.

- Project Margin = (Actual Revenue – Resource Direct Cost – Other Direct Costs) / Actual Revenue.

In the analysis of project profit/margin, only the portion(s) of other direct costs that have not been reimbursed are subtracted from actual revenue. For many professional services organizations, project profit/margin is a more accurate accounting of historical profitability since unreimbursed costs are factored into the equation along with resource direct costs.

This is especially true for organizations whose other direct costs are significant as compared to resource costs — for instance, at companies that purchase advertising time on behalf of its clients. This measure helps organizations to ensure that issues related to direct costs become apparent quickly.

Rate Realization Overview

Rate realization helps an organization to identify what factors may have contributed to an organization’s inability to realize its originally stated earning potential. Put another way, it focuses attention on what could have been earned vs. what was actually earned. It also provides data often used by analysts to understand the financial viability of services organizations, and to compare the health of one organization against another.

This analytical model involves comparing the three types of rates against themselves. These comparisons can be described as:

- Rates – the difference between contract rates at which a project was sold and the cost center’s standard rate card.

- Revenue – the difference between actual and contract revenue for a particular engagement.

- Percentages – the contract rate divided by the standard rate, expressed as a percent.

For consistency, percentages in the context of rate realization are generally expressed in terms of portions of the baseline measure, as opposed to percentage differences. For instance, in the example above, if the standard rate was $200/hour and the project was sold at a contract rate of $160/hour, this relationship is expressed in Projector by BigTime’s reporting module as a Contract % of Standard equal to 80%, as opposed to a 20% discount.

The graphic shows how rates fluctuate through the course of sales and delivery. Understanding and tracking at a micro level allows organizations to diagnose where rates deviated from plan, and why.

Rate Realization Metrics

Let’s break down three places where rates can be measured and managed. These metrics form the basis of rate reporting and are key to understanding where rates can go awry in your organization:

Rate Realization: Actual % of Standard

The first aspect of rate realization analysis is comparing actual rates to standard rates. This difference describes how much the operations of an organization truly earned from its clients (actual rates), as compared to what it theoretically could have earned (standard rates), had the clients been charged the non-discounted rates. Actual % of Standard does not try to identify what aspect of the organization, sales or delivery, had a larger impact on profitability, it simply provides a consolidated look at the organization’s actual performance as compared to its theoretical current earning potential.

Rate Realization: Contract % of Standard

We use Contract % of Standard to understand what discounting was done to sell the engagements at the outset. Contract % of Standard describes the difference between a resource’s standard rate and reductions in that rate due to:

- Discounting entire projects – i.e., giving clients a percentage discount off an entire project

- Discounting individuals – i.e., charging a client a less expensive rate for an individual

- And in some cases – i.e., selling a fixed price project for which an artificial “discount” may be applied

The Contract % of Standard figure will vary from organization to organization depending on the sales and marketing practices of the company. Some service organizations intentionally structure their rates higher than market norms and regularly discount their standard rates when selling business. Others make it a practice not to provide discounts and sell their business at their published rates.

Like the Actual % of Standard metric, Contract % of Standard uses standard rates as its baseline, so will tend to decrease over time as standard rates rise.

Rate Realization: Actual % of Contract

Actual % of Contract compares the revenue that the organization actually generated from its clients (actual rates) as compared to what it should have earned based on the initial client contract (contract rates). Because this metric uses (in its numerator) only revenue actually paid by clients, and (in its denominator) amounts that a client would have paid – had they paid negotiated prices for every hour worked – it shows the effect of a host of issues:

- Write-downs

- Cost overruns on capped and fixed price projects

Most of the issues that are included in this metric relate to project delivery problems and poor estimation. Generally, the Actual % Contract metric shows the effect of hours that are expended in the delivery of a project that the organization doesn’t expect to be paid for.

Using a PSA Tool to Conduct Project Profitability Analysis

As with most business analytics, the right software can make all the difference. Project accounting software will deliver some amount of data around rates and earnings. Some tools may even have a project accounting subledger. PSA solutions blend the data of the entire delivery organization, and do so in a way that makes analysis at every level of the organization easy and manageable.

Note that project profitability analysis uses only hours actually expended when it calculates revenue and costs, and does not take into account the overall utilization of those resources. For instance, a 100-person organization with a single project that keeps 10 people fully busy will have utilization of 10%. Project profitability for that single project may be excellent, but profitability for the organization as a whole may be poor. Because of this, organizations need to take a resource utilization formula into account when correlating P&L profitability targets with project profitability data.

Both rate realization and project profitability analyses can be accomplished through the use of BigTime’s analytical reporting capabilities. Users can run project and resource profit/margin analyses based on many different entities including cost centers, departments, locations, clients, engagements, projects, and resources. Each of these different types of analyses can be run for certain periods of time, for engagements unconstrained by time, or for trends over time. Projector BI was built with the specific needs of professional services organizations in mind. The business intelligence tool brings project, utilization, staffing and financial data together in meaningful ways – allowing services organizations to make informed business decisions and achieve better project delivery results.

To learn more, download our Metrics That Matter white paper to understand the essential KPIs for services and how to track them, or our e-book on how to use project profitability analysis and other key strategies to fuel growth.

Frequently Asked Questions About Project Profitability Analysis

What is project profitability?

Project profitability is a measurement of how much money a project can make for your business, or the financial gain or loss on a project. Project profitability can be expressed in terms of Profit (i.e., the amount of revenue left over after accounting for costs) and Margin (i.e., the profit compared to the revenue, expressed as a percentage).

What is rate realization?

Rate realization is the blending of utilization and rates to understand whether the potential for earning was achieved. It helps an organization to identify what factors may have contributed to an organization’s inability to realize its originally stated earning potential.

What is project profitability analysis?

Project profitability analysis compares the revenue generated by doing work for a client (actual revenue) versus the cost to the organization for delivering those services (salaries and other direct costs). It allows managers to use financial and scheduling data to understand how profitable the ongoing operations of an organization are.

How to calculate project profitability?

Project profitability and resource margin are calculated as follows:

Project Profit = Actual Revenue – Resource Direct Cost – Other Direct Costs

Project Margin = (Actual Revenue – Resource Direct Cost – Other Direct Costs) / Actual Revenue

.png)