While many aspects of work look different these days — your desk, work attire, and pets making cameos in conference calls — the one thing you don’t want to be disrupted is your cash flow. Working remotely means your business needs to adapt to a virtual environment.

If you’ve been struggling to keep up with invoices and payment collection from clients out of the office, keep reading for a list of tips from our CFO, and what we’re doing to keep our finances as consistent as possible.

Have an option for electronic payment

Physical payments through check cause many delays, and when embracing physical distancing the timeline only is slowed down further. Checks still being mailed to our office means sending in a person one day a week to receive them. If you don’t have a remote scanner, that employee also has to go to the bank to deposit. Electronic payments via ACH or credit card eliminate these steps and expedite the process. Giving clients the option to pay through an electronic method will eliminate many hurdles for both you and your clients, speeding up the process.

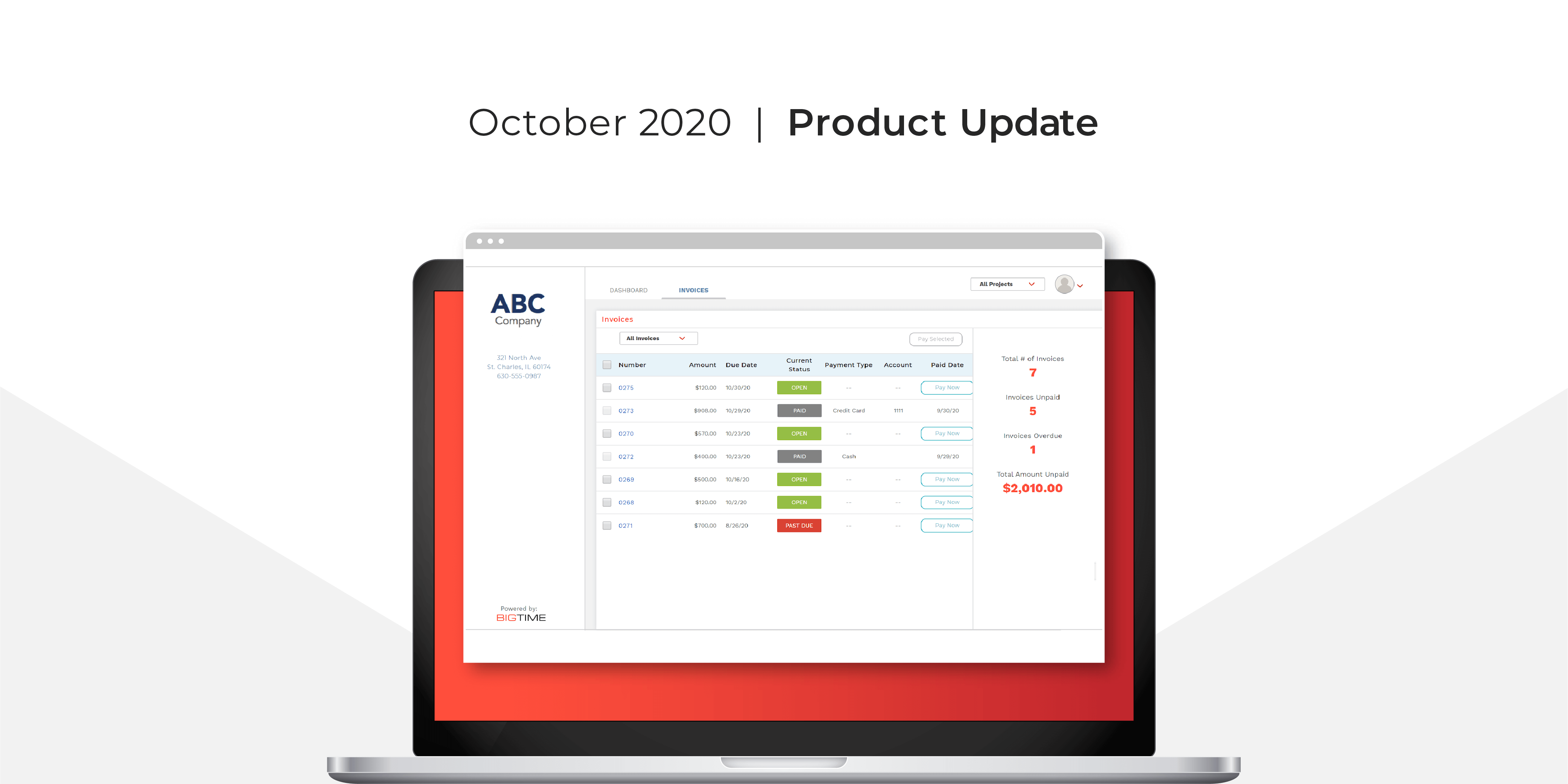

Cloud-based invoicing software

Constructing invoices manually in Excel and mailing them out is a cumbersome process. Not only does it cause bottlenecks for sending your invoice on time, but it also makes it harder for your client to pay electronically. In order to collect electronic payments, it’s best to make the switch to invoicing software, like BigTime, that sends your invoices digitally so they end up directly in your client’s email inbox.

Flexible invoicing software also means you have more options for when you send out invoices, and you can increase the frequency if needed. By making it quick and easy to send an invoice you can ensure every invoice is sent on the first of the month, even if it’s in the middle of the week, or split your clients to invoice half in the middle of the month and the other half at the end of the month to keep payments consistently coming in.

Set a preferred payment method

To encourage clients to follow your digital footsteps and use a faster electronic payment method, be clear in your preference. Communicate the benefits of eliminating checks, especially for remote work when having checks physically signed is a more difficult task. Most electronic payment software will also allow you to set a default payment method for ACH or credit card so clients are more inclined to choose the easiest option.

Keep Reporting Fluid Between Finance and Project Managers

Another internal roadblock that slows down payments, yet is easy to correct is the review and approval process. Housing your project management and financial data in the same professional services automation platform will keep your finance and project management teams aligned virtually. Instead of relying on the teams to gather data and share files, real-time reporting that combines project budgets and actuals can be shared through the cloud. Fewer corrections will be needed in the invoicing process, and the finance and project management team can work in sync to send the invoice out, all within the same platform.

Keep a close watch on expenses

Managing cash flow isn’t all about bringing new money in, it’s also about keeping what’s already in your pocket. Keeping a close watch on your expenses and resources. It can feel like it’s harder to manage your business without everyone in the office, but with the right tools, you can see keep a daily pulse on your expenses and how your staff is being utilized to make sure you stay on track. Use resource allocation and expense reports to spot where money or time is being spent inefficiency and look for ways to resolve it.

Working remote means your business needs to depend on more virtual solutions, and doing so makes your firm more agile and efficient in the long run. We hope you use these tips as a launch point to streamline your internal workflows so your cash flow stays consistent and keep your business moving forward towards your goals.

If you’re interested in learning more about how the CARES Act can help your business through the coronavirus pandemic we’ve gathered resources on our blog here.

We also hosted a webinar with Illumination Wealth to share advice on how to maximize the benefits of your Payroll Protection Program loan, while avoiding reductions in forgiveness. Click here to watch!