What was that invoice for and where did that other bill come from?

Unfortunately, for numerous professional services companies, these questions are asked way too often. Fortunately, there is one way to prevent this situation from happening — it’s called cost allocation.

After reading this article, you should be able to:

- Define cost allocation and the factors that affect it.

- Identify the cost objects that need to be taken into account in the process.

- Use the cost allocation formula and cost allocation method to assign expenditures to departments and projects with accuracy.

Cost Allocation Definition

Cost allocation is the process of matching the cost objects with the departments or operations that generate them. It is mostly used for calculating the financial performance of a company or its parts, such as teams or projects, and determining where given cost objects came from.

For example, in a typical services company, costs can be allocated to non-production departments (i.e. marketing, sales, administration), as well as projects and teams.

What is cost allocation used for?

What’s the point of calculating all of these things?

While cost allocation is very helpful when it’s time to sum up employee performance, results of particular project managers, or finances that may interest stakeholders, there are other perks.

On a daily basis, cost allocation can also help you:

- Ensure budgets are on track — both the budget of the entire company, as well as the finances of particular departments or projects.

- Identify the aspects of operations that generate excessive costs and act on that information.

- Check whether the company is spending money on the right endeavors.

In other words, cost allocation is the process of identifying the sources of the company’s costs and evaluating their importance.

Types of Costs in Cost Allocation

Cost allocation involves all the people and assets in the organization. Therefore, it includes dozens of different types of costs that project managers and executives need to take into consideration while managing project budgets and other finances.

Let’s take a look at the types of costs in cost allocation.

Basic Costs in Cost Allocation

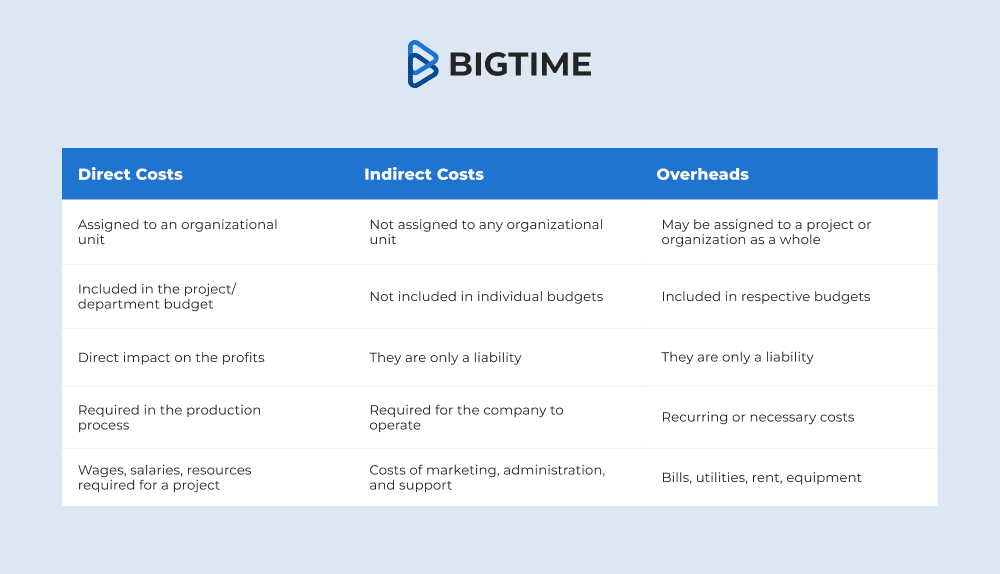

In the simplest classification system possible, costs in a cost allocation are divided into 3 categories:

Direct Costs

Direct costs in cost allocation are spendings that have already been attributed to certain departments, projects, or teams, and there are no doubts as to their origin. These costs contribute to the profit billable operations are supposed to generate as they are required in the production processes.

For example, in a service company, direct costs are usually included in the project budget, or even a project timeline in general. They usually refer to wages and salaries, but they may also include other resources required for the project. Therefore, allocating this type of cost is a piece of cake, as they are generated directly by the department, services, or other cost objects they are related to.

Indirect Costs

The definition of indirect costs in cost allocation is a bit more complicated, especially for endeavors closely related to professional services. These costs are not associated with any organizational unit in particular; they are simply needed to keep the company running and growing.

Indirect costs usually include support staff wages and spendings made by the support staff that help the production department do its job. These include cost objects such as marketing and sales specialists, administrative employees, and any other support departments. Indirect costs also often include internal projects.

However, there is one more type of indirect cost in cost allocation that we need to consider — the overhead costs.

Overhead Costs

Overhead costs cover all the costs that need to be continually paid regardless of the company’s business performance.

Project Overheads vs Organizational Overheads

Overhead costs are usually divided into 2 categories:

- Project overheads, for example, equipment, subscriptions, and programs.

- Organizational overheads, such as utilities, bills, rent, etc.

- Cost of services needed to keep the company running, e.g. security expenses and business management.

Cost Allocation Method

At this point, you may ask yourself, “how can I allocate costs on my own?” Fortunately, the answer to this question is not as complicated as it may seem — here’s a cost allocation method that can help you.

Cost Allocation Method Example

Some organizations, particularly services companies, profit only from their projects, and they don’t need to allocate the costs for the entire business — they just need to share the costs between the profitable operations and departments, as well as other cost objects. Here’s what the process of identifying them looks like.

1. Define Which Costs You Want to Allocate

Begin by calculating the costs you want to allocate in the first place. For example, if you want to allocate the cost of utilities in your office, add them up to get a bigger picture.

For the sake of this cost allocation example, let’s assume that The Best Company is focused on allocating the costs of its support departments to the project for the month (also known as business overhead). The costs include:

- The costs of the marketing department: $40,000

- The costs of administration: $15,000

- The costs of the sales department: $45,000

Together, all these departments account for $100,000 of additional overhead expenses that need to be allocated.

2. Determine the Base for Sharing the Costs

Depending on the type of business, you can divide the costs based on different factors. The most popular ones include:

- Billable hours tracked in the services

- Generated income

- Generated profit

For this example, we’ll use the first of these indicators — billable hours. This method is considered the simplest way of allocating costs proportionally.

The Best Company has 2 projects — Project A and Project B.

To complete all the activities planned in Project A for the month, the project managers and their team members will need 1,800 hours. For Project B, the number of hours needed is 1,200. Both projects combined require 3,000 hours to complete. Therefore, Project A accounts for 60% of all billable hours in the company, while Project B includes 40% of them. These are the proportions we’re going to use in this cost allocation method.

3. Allocate the Costs Proportionally

If Project A includes 60% of all billable hours while Project B accounts for 40% of them, we can now use the numbers to determine the distribution of costs between them. Let’s focus on identifying how they should each contribute to costs.

According to the examples above, the total amount of costs to be shared among billable operations is $100,000. Project B requires more hours, therefore it should account for a larger chunk of the costs — exactly 60% of them. As a result, $60,000 of the costs are allocated to the project.

Project B, meanwhile, requires 40% of all the billable hours. Therefore, it should pay 40% of the costs — $40,000.

Benefits of Cost Allocation

While cost allocation is a burden, it’s also a huge business advantage.

With cost allocation, you can:

- Determine whether your projects are profitable.

- Learn what part each project plays in covering the organizational costs.

- Check whether the company’s rates are high enough to cover all the costs and generate profits.

- Determine whether indirect costs are eating up the majority of the company’s profits.

- Identify the actual cost of services you provide to your customers.

- Find out which departments are spending more or less money, and what they use it for.

- Assign any lost spending to the people, teams, or departments responsible for them.

- Calculate the real profitability of your business as a whole.